West End Kingston has been quite a ride over the past few years.

During the pandemic, prices shot up at a pace we’d never seen before. Almost everything sparked multiple offers and sold well over asking, sometimes within days. Buyers were rushing to lock in ultra-low interest rates, resulting in a frenzied market where competition was intense. This was a stark contrast to the market conditions we had seen in the years prior, with properties often sitting on the market for weeks or even months.

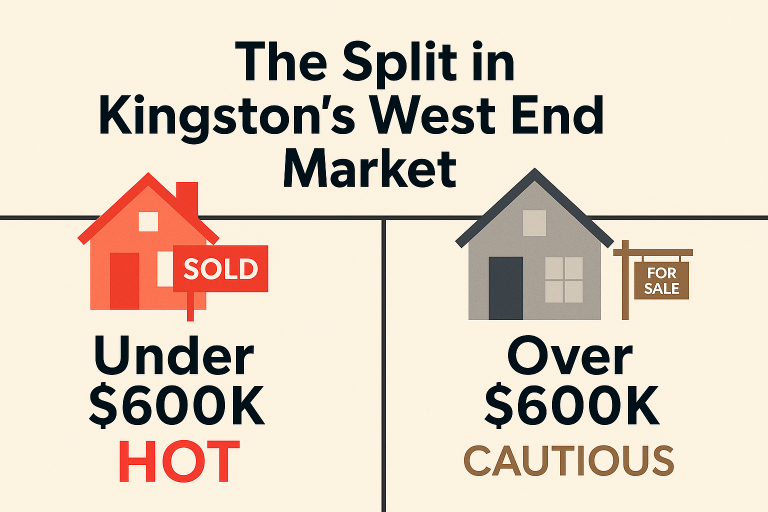

However, markets evolve, and this one has undergone significant changes. Prices have cooled from those peaks, and bidding wars aren’t nearly as common. Still, they haven’t dropped back to pre-pandemic levels either, which leaves us in an unusual place, a market that’s split in two. This means that homes under $600,000 are still in high demand, while properties priced above that threshold are experiencing slower sales, longer days on market, and more cautious buyers.

From where I sit, most homes priced under about $600,000 are still in high demand, selling at a healthy pace. This is encouraging news for potential sellers in this price range.

Here’s what that means if you’re thinking about selling in West End Kingston this fall.

🏡 The Hot Zone: Homes Under $600,000

Under $600,000 is where most of the action is happening in West End Kingston.

Buyers in this price range are typically first-time buyers, downsizers, or young families, and this group remains very active. For them, a well-priced, move-in-ready home under $600,000 checks the boxes: it fits within tighter mortgage budgets, and it provides stability at a monthly cost that feels manageable.

Since the beginning of June, many well-kept detached homes across West End Kingston have sold quickly:

-

768 Cataraqui Woods Dr — sold in 4 days

-

781 Downing St — sold in 4 days

-

852 Allum Ave — sold in 3 days

-

611 Bourne Pl — sold in 14 days

-

691 High Gate Park Dr — sold in 9 days

-

788 Whiteoak Crescent — sold by Bill Stevenson, Century 21 Lanthorn Real Estate

788 Whiteoak Crescent — Sold by Bill Stevenson, Century 21 Lanthorn Real Estate

Others, like 1610 Anne St ($519,000, 38 DOM), are currently listed and drawing steady interest.

These sales reflect what I’m seeing daily: homes under about $600,000 are still drawing strong demand, provided they’re clean, well-maintained, and move-in ready.

That said, not everything sells quickly just because it’s under $600,000.

Condition matters more than ever. If a property requires extensive work — especially major items like kitchens, bathrooms, or roofs — it tends to remain unsold unless it’s priced significantly below market value. Renovation costs have stayed high, and buyers are wary of taking on significant projects while material and labour costs remain unpredictable.

The takeaway: If you’re selling for under $600,000, presentation counts. Clean, repair, declutter, and make sure your pricing reflects today’s market, not the frenzy of 2021.

💸 The Caution Zone: Homes Over $600,000

In the upper tiers of the West End Kingston market, the pace has slowed as buyers become more selective.

This segment has seen a noticeable slowdown in the past year. The buyer pool shrinks significantly once you get over $600,000, and particularly in the $700,000 to $900,000 range, properties often take much longer to sell and frequently see one or more price reductions.

For example, in West End Kingston since June 1:

-

855 Woodbine Rd — $649,900, 48 DOM

-

1429 Avondale Cres — $649,900, 58 DOM

-

785 Allum Ave — $699,000, 10 DOM (still active)

-

58 Cliff Crescent — $699,500, 25 DOM

58 Cliff Crescent — Listed at $699,500 by Century 21 Lanthorn Real Estate -

926 Cresthill St — $749,900, 58 DOM

-

359 Ellesmeer Ave — $750,000, 27 DOM

-

1303 Rockwood Dr — $849,900, 4 DOM (new listing)

-

1290 Matias Crt — $979,900, 45 DOM

-

564 Braeside Cres — $1,050,000, 51 DOM

These are good homes, many of which are beautifully updated, yet they’ve required longer marketing windows and more patience from their sellers.

It’s not that there aren’t buyers in this range — there are. But they’re moving more carefully now, and they expect value for their money. That usually means turn-key condition, desirable locations, and standout features like energy efficiency, newer systems, or thoughtful upgrades. Homes that feel “average” but are priced as if it’s still 2021 are sitting on the market.

In today’s cautious climate, overpricing is a risky strategy.

Buyers in this bracket tend to closely watch listings, wait for price reductions, and only act when they see something exceptional or well-priced

___________________________________________________________________________________________________________________________________________________________________

The Stress Test Effect: Why $600K Can Be a Ceiling for Many Kingston Buyers

One reason to be especially cautious above the $600,000 mark is the mortgage stress test. In Canada, lenders must qualify borrowers at the higher of their contract rate + 2% or the government’s minimum qualifying rate (currently 5.25%). This means that even if your actual mortgage rate is 4.5%, the bank will make sure you can afford the payments as if your rate were 6.5%.

This often surprises Kingston buyers. Even if they feel confident about the payments at today’s rates, they may not qualify for the loan amount they expect once it’s tested at the higher “what-if” rate.

Here’s what that does to buying power:

-

At a 4.5% actual rate and a 6.5% stress-tested rate, a household that earns $110,000 annually with 10% down could afford about $595,000.

-

That same household trying to buy at $650,000 would need either a higher income (~$120,000+) or a larger down payment (15–20%) just to qualify.

This hidden cap created by the stress test explains why listings just under $600K are moving quickly in West End Kingston, while those above often linger or see price reductions — even if the monthly payments might look similar on paper. It’s not about willingness to pay; it’s about qualifying.

How the Stress Test Shrinks Buying Power

Table caption (for SEO): Mortgage stress test income requirements for typical Kingston home purchases at different price points, based on 10% down and 25-year amortization.

Alt text (for screen readers/SEO): Chart showing how household income needed rises from about $102K at $550K to $128K at $700K home price under Canada’s mortgage stress test (Kingston 2025).

| Target Home Price | Required Mortgage | Down Payment (10%) | Income Needed (Approx.)* |

|---|---|---|---|

| $550,000 | $495,000 | $55,000 | $102,000 |

| $600,000 | $540,000 | $60,000 | $110,000 |

| $650,000 | $585,000 | $65,000 | $120,000 |

| $700,000 | $630,000 | $70,000 | $128,000 |

*Based on common lender guidelines: ~39% gross debt service ratio (GDS) and 25-year amortization, stress-tested at 6.5%.

Key takeaway: Crossing above the $600K threshold pushes many Kingston buyers beyond what they can qualify for, even if they could comfortably handle the payments at current rates. This helps explain why West End Kingston listings under $600K are hot while higher-priced homes see softer demand

📉 Why Buyer Behaviour Has Shifted

According to national data from REALTOR.ca, average home prices in Canada have shifted dramatically since the pandemic, and West End Kingston has been no exception. These shifts are reshaping the landscape, creating a more balanced market than during the pandemic frenzy. This balance should provide a sense of security for potential sellers.

Local statistics from the Kingston and Area Real Estate Association and HouseSigma indicate that buyers now have significantly more choice than they did just a few years ago.

Citywide data backs this up. According to the Kingston and Area Real Estate Association, in August 2025, the average Kingston & Area sale price sat at $606,963, almost flat month-over-month but 3.9% higher than last year, while sales volumes dipped 1.7% year-over-year and active listings climbed to 1,325 (up 8% vs 2024 and 34.7% vs 2023).

The sales-to-new-listings ratio is 44.9% and there are 4.7 months of inventory, which confirms a balanced market — far from the 79% ratio and just 1.3 months of inventory we saw during the 2020 frenzy.

📊 Kingston & Area Market Snapshot — August 2025

(Source: Canadian Real Estate Association via Kingston and Area Real Estate Association)

-

Average sale price: $597,275 — up 3.9% year-over-year

-

Median price: $572,500 — up 4.1% year-over-year

-

Sales: 237 — down 1.7% vs Aug 2024

-

New listings: 498 — down 3.1% vs Aug 2024

-

Active listings: 1,325 — up 8.0% vs Aug 2024 and up 34.7% vs Aug 2023

-

Sales-to-new-listings ratio: 47.6% — indicating a balanced market (well below the ~79% seen in 2020’s frenzy)

-

Months of inventory: 5.6 — up from 5.1 last year and 4.2 in 2023

-

Median days on market: 29 — longer than 25 days last year

🏡 Kingston & Area Single-Family Segment

(This aligns closely with West End detached homes)

-

Average sale price: $630,850 — up 4.8% year-over-year

-

Median price: $592,500 — up 4.4% year-over-year

-

Sales: 194 — down 6.3% vs Aug 2024

-

Active listings: 1,036 — up 4.3% vs Aug 2024

-

Months of inventory: 5.3 — up from 4.8 in 2024

-

Median days on market: 26 — up from 23 last year

🧭 How I Help Sellers Navigate This New Market

One of the most important roles I play as a REALTOR® is helping sellers set realistic expectations from the start. That means:

-

Using current comps, not pandemic peaks. I show sellers what’s actually selling now, how long it’s taking, and how many price reductions those homes needed.

-

Tailoring pricing strategy by price bracket. For sub-$600,000 listings, we often employ a sharper, more competitive pricing approach to generate interest quickly. For properties valued at $600,000 or more, I advise building in more time and sometimes allowing for room for negotiation.

-

Focusing on presentation and value. Especially at the higher end, small details matter, from professional photography and staging to highlighting upgrades, warranties, and energy efficiency features.

-

Sharing honest feedback. If showings are slow or buyer feedback suggests the price is high, I don’t sugar-coat it. Adjusting early is better than sitting too long.

Ultimately, sellers who approach the West End Kingston market with a clear-eyed strategy continue to achieve strong results. The difference now is that success requires more preparation, patience, and market awareness than during the pandemic boom.

📍 My West End Perspective, and Where to Find Me

While our new Century 21 Lanthorn Real Estate West End office in Bayridge Centre Plaza hasn’t officially opened yet, I’m there most mornings, staying close to the pulse of this market and watching how buyer behaviour is shifting in real time.

Being here every day gives me a front-row seat to how buyer traffic is changing — which homes are drawing interest, and which ones aren’t. That insight helps me guide sellers through pricing decisions that reflect reality, not just wishful thinking.

❓ FAQ: West End Kingston

Q: Are home prices in West End Kingston still high compared to pre-pandemic levels?

Yes. While prices have cooled since the 2021–22 peak, the average sale price in Kingston & Area was about $606,963 in August 2025, which is 3.9% higher than last year and still well above pre-pandemic figures. Homes under $600,000 are holding especially strong.

Q: Why are homes under $600,000 selling faster than higher-priced homes?

Homes under $600,000 attract the largest pool of buyers, including first-time buyers, downsizers, and young families, who are still actively searching. Above $600,000, buyers are more cautious due to higher mortgage costs and greater inventory, which slows the pace of sales.

Q: How long are homes taking to sell in West End Kingston right now?

It varies by price point. Many well-presented homes under $600,000 are selling in under two weeks, while homes over $600,000 often take 30–60 days or more, especially if they require updates or are priced too high.

Q: Is it still a good time to sell my West End Kingston home?

Yes — but strategy is essential. Homes priced under $600,000 can still sell quickly with a strong presentation and competitive pricing. Homes priced above $600,000 require more preparation, marketing, and realistic pricing to attract serious buyers.

Q: Can I find lower-priced homes in other parts of Kingston?

Yes, there are more affordable areas across the city, but location plays a significant role in determining value. West End Kingston remains a strong community due to its excellent schools, parks, and family-friendly reputation.

💭 Final Thoughts: Strategy Wins in This Market

West End Kingston isn’t in a slump — it’s in a transition. Buyers are still out there, but they’re more cautious and more selective.

Lower prices can still be found in other parts of the city, of course. Still, location plays a significant role in value, and West End Kingston homes have held their value substantially thanks to their schools, parks, and family-friendly reputation.

-

If you’re selling a home under $600,000, a clean, well-presented property at a competitive price can still sell quickly.

-

If you’re selling for above $600,000, you’ll need to plan for a longer market time and be prepared to demonstrate clear value for your price.

Either way, the right strategy, built on honest data and strong marketing, can help you succeed.

If you’re considering selling, I’d be happy to meet at the new office, review your home’s current market position, and talk through the best approach for your situation.

Visit kingstonrealty.org to connect.