Every so often, I meet someone who says, “I cannot get a mortgage right now, but I have found a rent-to-own program that will get me into a house.” Understanding the risks involved is crucial before considering this option, because it can have significant financial implications.

On the surface, it sounds perfect. You move into the home now, part of your payment goes toward a future down payment, and you lock in a purchase price so you can buy in a few years when your finances look better.

The problem is that rent-to-own is not a government program or a standard bank product. It is a private contract. What protection you get depends entirely on the contract’s wording and its compatibility with Ontario law. Many times, the agreement’s wording favors the seller or the company offering the program, leaving the tenant buyer at the greatest risk of loss if anything goes wrong.

This is a plain-language look at how rent-to-own works in Ontario, how it differs from lease-to-own, why it appeals to some buyers, and where the real dangers are if you are considering it in Kingston and the area.

How a typical rent-to-own deal works

In Ontario, one of these arrangements usually involves two main parts.

The first part is a lease that appears to be a regular rental agreement. It sets out the term, the monthly payment, and the day-to-day rules for living in the home.

The second part is where the “own” comes in. It is an option or a promise to buy the home at a set price at the end of the lease. That agreement specifies the future price, the timeframe for completing the purchase, the upfront payment amount, the portion of your monthly payment credited toward your eventual down payment, and the consequences if you are late, need to move, or cannot finalize the deal.

Here is a simple, rounded example.

Imagine a home in the Kingston area with an agreed purchase price of $600,000. In today’s market, a property like that might rent for about $ 3,000 a month. Under a rent-to-own agreement, instead of a bank usually asking for the full five percent down payment, you might pay a smaller flat amount up front, something between $ 10,000 to $ 20,000.

Let us use $15,000 as an example of that initial option fee. On top of that, the provider might set the rent at $ 3,500 a month and credit $ 500 a month toward your future down payment. Over three years, that adds another $18,000 in credits. At the end of the term, you would have 33 thousand dollars that counts toward your down payment, but only if you complete the purchase on time and exactly as written in the contract.

In most of these arrangements, you are still paying first and last month’s rent as well, so the move-in costs are more than a standard rental, but less than a full five percent down payment on a 600 thousand dollar purchase.

One key point. That $500 “credit” each month is not sitting in a separate savings account in your name. It is simply a bookkeeping entry. If you do not complete the purchase, the contract will usually say that you lose those credits and your upfront fee.

You can see why this still requires cautious thought before signing anything.

________________________________________________________________________________________________________________________

Is rent-to-own legally recognized in Ontario

It is important to understand that “rent-to-own” is not a special, protected category of real estate contract in Ontario. There is no separate section of Ontario law that defines or regulates rent-to-own as its own product.

In almost every case, what you are signing is two legally recognized documents: a residential lease governed by the Residential Tenancies Act, and a separate option to purchase or purchase agreement governed by ordinary contract law.

That distinction is critical.

During the lease term, you are a tenant, not an owner. Paying extra each month does not give you equity in the legal sense. The upfront option fee does not put your name on the title. Until the purchase actually closes, you do not own the property.

If missed payments or a breach of the agreement cause the option to purchase to be cancelled, expire, or end, the law will enforce the contract’s written terms. Courts look at the wording of the documents, not the marketing language used to sell the program. If the agreement says the option is void after a late payment, that clause can carry actual weight.

That is why independent legal advice is not optional in these situations. You are not just renting with a twist. You are entering a private contract that can expose you to significant financial loss if anything goes wrong.

If you would not sign a standard purchase agreement without a lawyer, you should not sign a rent-to-own agreement without one either.

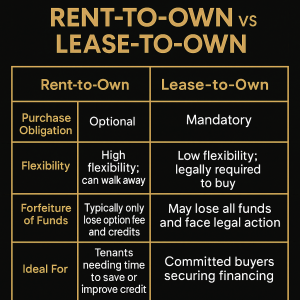

Rent-to-own versus lease-to-own

People use “rent-to-own” and “lease-to-own” as if they mean the same thing. They have a connection, but they are not the same, and that distinction is crucial if problems arise.

In a typical rent-to-own arrangement, you pay rent and have the option to buy the home later. You plan to buy, but you are not strictly required to. If you decide not to go ahead or cannot pull the financing together, you usually lose your option fee and your credits, but you are not being sued for failing to buy the property.

Lease-to-own agreements can create a firm obligation to buy, and failing to do so may cause legal consequences, including the loss of all invested funds and potential lawsuits for breach of contract.

Most Ontario plans comprise two separate documents, irrespective of their labels. One is the lease, which sets out the rent, the term, and the everyday responsibilities. The Residential Tenancies Act usually treats that part like any other residential tenancy. The second piece is the option to purchase or purchase agreement, which sets the price, the timeline, and the credits. That second agreement is not a standard landlord-tenant document. It is a private contract that decides what happens to your money and what you are required to do at the end.

That split is where much of the risk lies for ordinary buyers. On the surface, it can look like you are “just renting with a twist,” but in reality, you are stepping into a structure that is part rental and part future sale, with very real financial consequences if you cannot complete the purchase on the exact terms agreed.

Because of that, anyone in Kingston and the area who is seriously considering rent-to-own or lease-to-own should have a qualified real estate lawyer review the entire package before they sign. A brief review now is far cheaper than finding out later that the contract tied your hands in ways you never expected.

Key differences at a glance

If you prefer the short version, here is the basic comparison.

Rent-to-own, also called a lease option, usually gives you the right to buy, but not the obligation. It is more flexible. If you walk away, you typically lose the option fee and the rent credits, but that is where the damage stops.

Lease-to-own, also called a lease purchase, is usually a binding agreement to buy at the end of the term. It is less flexible. If you cannot complete the purchase, you may lose all your funds and, depending on the contract, face legal action for failing to close.

Rent-to-own can suit tenants who need time to save or improve their credit and want flexibility. Committed buyers who are confident they will secure financing by the deadline and want to lock everything in now should consider lease-to-own.

Why does rent-to-own appeal to some buyers?

There are legitimate reasons some people consider rent-to-own.

The first is timing. A buyer may have a steady income and excellent prospects, but cannot qualify for a mortgage today because of a short employment history, past credit problems, or a lack of a down payment. A rent-to-own arrangement gives them a fixed period to clean up their credit report, pay down debt, and build some savings while they are already living in the home they hope to own.

The second is certainty. Many rent-to-own contracts set the purchase price at the beginning. If the market rises during the term and values climb, buying at the pre-agreed price can create instant equity. From the buyer’s point of view, they feel as if they have locked in a price that might look cheap a few years later.

There is also the lifestyle piece. Living in the home and the neighbourhood before you commit can be helpful. You find out what rush hour really looks like, how the school drop-off works, what the heating bills are like in February, and whether the house still feels right after two or three winters. Some people like the idea of “trying” their future home while they work on their finances.

Finally, there is the discipline of a built-in savings structure. For buyers who struggle to save on their own, the higher monthly payment can act as a forced savings plan. That payment’s portion functions as a credit for the future purchase instead of vanishing into day-to-day spending.

Those are the parts that make rent-to-own look attractive. They are real. The challenge is that the risks on the other side are just as real, and in my experience, people often underestimate them.

The significant risks renters do not always see

The first and most significant risk is simple. If you do not buy the home at the end of the term, you could lose a substantial amount of money. That usually includes the upfront fee you paid and most, if not all, of the monthly rent credits.

Why might you not be able to buy when the time comes?

Sometimes it is personal. A job loss, illness, a change in a relationship, or a new family responsibility can affect your income or your debts. A payment that felt manageable in year one may feel impossible in year three.

Sometimes it is financial. Mortgage rules and interest rates change. Lenders can tighten their guidelines. A buyer who expected to qualify when they signed may find that the world has shifted by the time the term ends.

Sometimes it is the market. Although the price may have seemed fair when you signed the contract, a market slide during your term could lock you into a price exceeding the home’s current worth. That can make the purchase feel like a poor decision, even if the bank would still approve you.

The second risk is the higher monthly cost. Remember our example. You are paying 3,500 dollars for something that might rent in the normal market for about 3,000 dollars. That extra $500 is your credit, but it still has to come out of your monthly budget. If the payment is already tight at the beginning, there is not much room for unexpected car repairs, higher food costs, or interest rate changes on other debts. A deal that relies on everything going perfectly for three years is not very forgiving.

A third concern is responsibility for repairs and maintenance. In a standard rental, major items such as the roof, furnace, or plumbing are usually the landlord’s responsibility. Many rent-to-own contracts shift those responsibilities to the tenant-buyer. You could pay above-market rent and still be the one to pay for a new furnace if it fails in the middle of your term.

There is also the legal side. These are not standard one-page Ontario forms you sign in five minutes at a kitchen table. They are private contracts, and the seller or the program’s company often drafts many of them.

In a standard rental, the Residential Tenancies Protection Act protects you.. There are clear rules about rent increases, notice periods, and the limited reasons a landlord can ask you to move. With rent-to-own, the lease may still sit under that Act, but the purchase contract does not. Suppose something goes wrong on the purchase side. In that case, the owner or program operator can more easily end the agreement and have you moved out than in a standard landlord-tenant situation, especially if the contract says they can cancel your option the moment you are late or breach one condition.

The last risk is the illusion of certainty. People often feel that they have guaranteed their path to home ownership once they sign a rent-to-own contract. In reality, the opposite is true. You are committing yourself to a particular property, at a fixed price, on a fixed timeline, with strict rules. Life is not always that tidy.

Who actually qualifies for rent-to-own

There is a big misconception about who rent-to-own is for. Many people hear “you need less than five percent down” and assume this is a way for low-income households, or people with no savings at all, to buy a home. That is not how better programs work.

Responsible rent-to-own providers still do a fairly strict qualification process. They want to see a substantial household income, a realistic budget, and at least some savings or the ability to build savings. You are likely to qualify for a regular mortgage at the end of the term, so they will usually run the numbers with a mortgage broker up front to see if that is even realistic.

The conversation with a good provider sounds more like this.

Right now, your credit shows damage, but your income remains strong, and you possess some savings. If you stick to this plan, you should be able to qualify in three years, so we are prepared to work with you.”

A responsible operator will not take someone’s last few thousand dollars if the numbers clearly show there is no way they will ever qualify for the final mortgage. That is the theory, at least. In practice, not every company is that careful, which is why you want your own team around you, not just theirs.

If someone has no savings, a very modest income and no room in the budget, rent-to-own is not a safe shortcut. It is simply a more expensive way to fail later.

What about vendor take-back mortgages?

In a slower market, you may hear more talk about vendor take-back mortgages. This is a different idea from rent-to-own.

With a vendor take-back, you are buying the home now. The seller agrees to act as the lender for part of the financing, usually as a second mortgage to your primary bank mortgage. You own the property from day one and pay the seller back over time, in addition to your regular mortgage payment.

A vendor take-back can help a qualified buyer bridge a gap in the numbers, especially if a home has been on the market for a while and the seller is flexible. It is still real debt. You still need to qualify for your primary mortgage and make a minimum 5% down payment.

Just as with rent-to-own, any vendor take-back mortgage requires careful legal and financial advice. The interest rate, term, and repayment schedule all matter, and your lender has to agree to it.

Local alternatives to explore

For some buyers in Kingston and the area, local programs can be part of the solution. One example is the City of Kingston’s Home Ownership Program, which has offered qualified buyers help with a portion of their down payment, subject to income limits, purchase price caps and other conditions. Program rules can change, and funding is not always available, so it is essential to check the current details on the City of Kingston website and talk to your mortgage professional about how it would fit with your financing plan.

These kinds of programs are not a magic fix, but they are worth exploring before you sign a private contract that puts a lot of your own cash at risk.

FAQ

Is rent-to-own the same as a regular purchase with a long closing

No. With a regular purchase, you own the home on closing day, even if you have negotiated a longer closing. With rent-to-own, you are a tenant during the term. You do not own the property until the day you complete the future purchase, if you complete it at all.

Is rent-to-own a government or CMHC program

No. Rent-to-own and lease-to-own agreements are private contracts between individuals or between a buyer and a company. CMHC and the major banks may be involved at the end if you qualify for a mortgage, but the structure itself is not an official government program.

What happens if I cannot get a mortgage at the end of the term

In most cases, if you cannot arrange financing and you cannot buy, the agreement ends, and you lose the upfront fee and your rent credits. You will also need to move. There is rarely any refund, even if you were very close to qualifying. Check Ratehub mortgages for their take on rate-to-own.

Is rent-to-own a good idea if I have no savings and bad credit

That is precisely the situation where the risk can be highest. If the payments are already a stretch and you have no emergency cushion, any change in your life can cause the deal to collapse. In that case, straightforward renting and a focused savings and credit repair plan are usually safer.

Should I get a home inspection on a rent-to-own property?

Yes. You should treat a rent-to-own or lease-to-own property as if you are buying it, because that is the long-term goal. A proper home inspection can uncover issues with the roof, foundation, wiring, plumbing, or moisture that could become problems later. Ideally, you arrange the inspection before you sign the option to purchase, or you build the right to an inspection into the agreement itself. Even if the owner is still responsible for major repairs during the lease, you want to know what you are walking into and whether the future price still makes sense once the home’s condition is clear.

Can rent-to-own or lease-to-own ever be a good idea

Yes, in some narrow situations. It can work when the buyer has substantial income, a clear and realistic plan to qualify for a mortgage within the timeframe, and a genuine long-term interest in that specific property. It also needs a carefully written contract, a fair purchase price and proper legal and financial advice. Even then, it is not a magic shortcut. It is one tool in a particular set of circumstances.

________________________________________________________________________________________________________________________

Don’t Miss These Guides

Match the Home You Buy to Your Budget: What Kingston Buyers Need to Know

A practical look at how to match purchase price, mortgage payments, taxes, and ongoing costs to your real financial comfort zone before you commit.

First Home Purchase: Kingston Area

A step-by-step guide for first-time buyers covering mortgage pre-approval, deposits, conditions, inspections, and what to expect from offer to closing.

Relocating to Kingston and Area in 2026

An overview of neighbourhoods, commuting patterns, pricing ranges, and local considerations for buyers moving into the Kingston region.

Home Inspections: Benefits for Buyers and Sellers

Explains what a proper home inspection covers, when to schedule it, and how it protects you whether you are buying traditionally or considering rent-to-own.