Purchasing a home is exciting, but buyers should also be aware of the potential deal breakers that may affect financing, insurance, resale value, or long-term suitability. Some concerns arise from what an inspector observes on site, while others only appear when reviewing documents, permits, or municipal information. These are best understood as possible deal breakers, since many issues can be negotiated or resolved with the correct information and professional guidance.

A REALTOR® helps buyers and sellers navigate these concerns by gathering details, identifying red flags and advising when a specialist should be consulted. This article outlines the most common possible deal breakers in a home sale and explains why they matter. As with any property, conclusions are based on the information available at the time of the transaction. When major issues appear, engineers, septic experts, water testers, lawyers or other qualified professionals may be needed to complete the assessment.

Structural movement and foundation issues can be deal-breakers.

Significant structural concerns are among the most common reasons buyers reconsider a purchase. A home inspector may note deterioration, shifting, bowed walls, or large cracks that could impact safety and stability. These issues often influence buyer confidence and negotiation strategies, as they can affect long-term costs. Engineers help determine the seriousness of the problem, and depending on their findings, it may be a deal-breaker; some buyers opt to negotiate repairs or price adjustments.

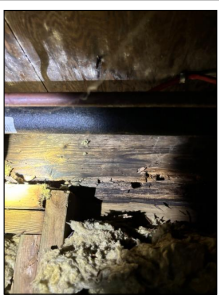

Roof problems and attic warning signs

A failing roof can lead to leaks, mould, ventilation problems and future repair bills. Missing shingles, poor flashing, sagging lines or attic staining often signal that replacement is approaching. These concerns may influence negotiation strategy if the buyer faces high future costs. For some, this becomes a deal-breaker; for others, it is a manageable repair.

Plumbing concerns that may become deal breakers

Older plumbing systems, slow drains, visible leaks and evidence of past water damage can influence a buyer’s decision. While many plumbing issues can be addressed, concerns such as deteriorated supply lines or chronic leaks may require a licensed plumber for a complete evaluation. In rural homes, additional considerations include the condition of wells, pressure systems, and water quality. When plumbing concerns carry long-term cost implications, they may become possible deal breakers, depending on the buyer’s comfort level.

Electrical hazards can be a deal-breaker.

Outdated panels, open grounds, aluminum wiring and amateur renovations can create safety issues and affect insurance eligibility. Some electrical updates are straightforward. Others may involve panel upgrades, rewiring or improvements that add unexpected cost. Whether this becomes a possible deal breaker depends on the buyer’s budget, insurance requirements and timeline.

HVAC and mechanical failures

Mechanical issues such as a furnace that will not start, a blower motor showing signs of failure or older equipment approaching end-of-life can influence negotiations. Heating and cooling systems are essential in our climate, and major replacements can affect affordability. These concerns often prompt buyers to seek further evaluation from HVAC technicians. They may become deal breakers or items to negotiate.

Moisture, water intrusion and mould

Moisture concerns can have long-term implications for structure, indoor air quality and repair costs. Staining, musty odours, swollen materials or visible mould growth often indicate the need for further assessment. Whether moisture becomes a possible deal breaker depends on severity, cause and remediation requirements.

Exterior envelope issues

Poor siding condition, rotting trim, cracked masonry or deteriorated caulking can invite water intrusion. In some cases, these issues require extensive remediation. Buyers must understand the potential scope of work before deciding whether this is a possible deal breaker or a manageable future improvement.

Pests and wildlife intrusion

Rodent or insect activity may indicate entry points, damaged insulation or sanitation concerns. Pest control specialists can clarify the extent of the issue and the repairs required. Depending on the buyer’s tolerance and budget, this can become a possible deal breaker.

Renovations completed without required permits

Renovations become a concern when they involve structural changes, additions or major plumbing and electrical alterations, particularly when these upgrades change how the property functions. Work such as building an addition or garage, constructing a large deck, significantly altering the structure, installing a pool or finishing a basement to add new living space generally requires municipal permits and inspections. When substantial improvements are completed without proper approval, buyers may face uncertainties about safety, insurance, resale value, and the municipality’s willingness to approve future changes. For some, this becomes a deal-breaker; for others, it is simply a matter of understanding what may be required to bring the work into compliance.

Title issues, liens, boundary concerns and estate-sale delays

Legal and boundary-related issues can surface during the document review stage and may affect a buyer’s ability to take ownership as planned. Liens, easements, unclear access rights or discrepancies in the legal description of the property often require clarification by a lawyer or surveyor. In some cases, these concerns can be addressed by updating documents or agreements. When legal issues are unresolved, they can create significant uncertainty, leading buyers to feel more cautious about proceeding.

Property boundaries can create additional challenges, particularly in rural areas where older surveys may be incomplete, fencing may not reflect the actual lot lines, or the recorded acreage may differ from what buyers expect. Rights of way, shared laneways, and long-standing informal access arrangements can further complicate ownership. When legal access is unclear or disputed, buyers may require additional investigation before moving forward. This issue is usually handled by the lawyers representing each side.

Estate sales introduce another variable. These transactions often involve multiple beneficiaries and additional legal steps before a property can be sold. In many cases, the estate must go through probate, the legal process that confirms the will and authorizes the executor to sell the home. Until probate is granted, the estate may not be able to set or guarantee a closing date. While some estates move through the process quickly, others take longer. For buyers who need a firm timeline, these delays can become a possible deal breaker.

Failing septic systems and holding tank restrictions

A failing septic system can be one of the highest unexpected costs for rural buyers. In some areas, updated environmental rules permit only a holding tank, which involves ongoing pumping and maintenance. These situations can often be deal breakers, depending on the buyer’s expectations and intended use of the property. See the Ontario Government page for septic tank questions: https://www.ontario.ca/page/septic-systems

Non-potable or contaminated water

Some wells produce water that does not meet drinking standards without treatment. Treatment systems can help, but buyers must understand testing requirements and long-term maintenance. For some, unsafe water is a deal-breaker, while others choose to install treatment systems.

Insurance barriers that can become deal breakers

Insurance challenges can arise for a variety of reasons, including older electrical systems, aging plumbing, wood-burning appliances or past claims. In rural areas, premiums can also be significantly higher due to longer fire response times, limited hydrant access or distance from the nearest hall. Some properties face additional restrictions when located in flood-prone areas or low-lying regions identified by conservation authorities. Insurance companies may require specific upgrades before offering coverage, limit certain risks, or decline coverage altogether. If buyers cannot obtain suitable insurance at a manageable cost, lenders may not approve the mortgage. These findings may be deal-breakers for some buyers.

Zoning and use restrictions

Buyers planning additions, secondary suites, hobby businesses or outbuildings may encounter zoning limitations, setback rules or conservation restrictions. When a property cannot support the buyer’s intended use, this becomes a possible deal breaker.

Understanding the decision-making process

A possible deal breaker does not automatically end a transaction. Instead, it indicates that more information is needed. Some issues can be negotiated or planned for. Others may exceed a buyer’s budget or comfort level. REALTORS® help clients interpret these situations, gather accurate information and know when expert opinions are required. With clear guidance, buyers can decide whether to move forward, negotiate improvements or choose a different home that better aligns with their needs.

FAQ

What is a possible deal breaker in a home sale?

A possible deal-breaker is an issue serious enough that a buyer may choose not to proceed unless more information is obtained or changes are negotiated. Many concerns can be resolved with expert opinion or adjustments to the offer, while others require the buyer to reconsider based on cost or risk.

Can deal breakers always be fixed or negotiated?

Not always. Some issues are manageable with professional repairs or price adjustments, while others involve safety risks, legal complications or high future costs that buyers may not wish to take on.

Are rural properties more likely to have deal breakers?

Rural homes often have additional considerations, such as septic systems, private wells, longer fire response times and insurance limitations. These do not automatically end a sale but may require additional due diligence before proceeding.

Does every renovation need a permit?

No. Cosmetic updates and non-structural interior work usually do not require permits. Concerns arise when major work, such as additions, structural changes or significant plumbing and electrical upgrades, has been completed without proper approvals. Check with your local authority.

Why do estate sales sometimes take longer to close?

Many estates must go through probate, a legal process that confirms the will and authorizes the executor to sell the property. Until probate is granted, the estate may not be able to set a firm closing date, which can affect buyers who require specific timelines.

Can unclear property boundaries affect a sale?

Yes. If surveys are outdated or rights-of-way are unclear, buyers may need clarification from a lawyer or surveyor. Boundary issues can influence access, planned uses, insurance and resale value.

Don’t Miss These Guides

Match the Home You Buy to Your Budget: What Kingston Buyers Need To Know 2026

First Home Purchase: Kingston Area

Relocating to Kingston and Area 2026