In 2026, many Kingston residents are asking the big question: should they rent or buy

The choice between renting and buying has never felt more important in Kingston this year. With rising rents and changing mortgage rates, the choice between renting and buying a home has never felt more important

In this post, we’ll break down the pros and cons of renting versus buying, with a Canadian focus, so you can make a confident choice.

The Case for Renting

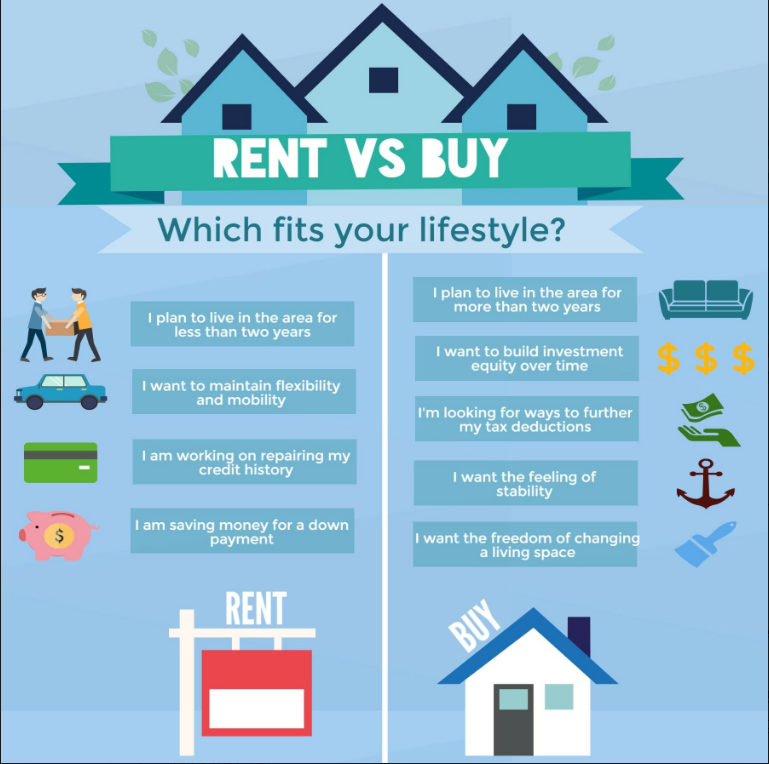

Renting often gets dismissed as “throwing money away,” but that’s not the whole story. Renting provides flexibility, especially for younger Canadians, newcomers, or those unsure about staying in one place long-term.

Here are some key advantages:

-

Lower upfront costs. You don’t need tens of thousands for a down payment, closing costs, and moving expenses.

-

Flexibility. Renting lets you move easily if your job changes, family needs shift, or you simply want a new neighbourhood.

-

Fewer maintenance surprises. Roof leaks, broken furnaces, or plumbing issues are the landlord’s problem, not yours.

-

Access to prime locations. In markets like Toronto or Vancouver, where buying may be out of reach, renting can still get you into the neighbourhood you want.

The downside, of course, is that your rent doesn’t build equity. Rents have also been climbing sharply across Canada, meaning the “savings” can disappear quickly. A Kingston two-bedroom that was $1,200 a few years ago can now easily be $1,900 or more.

The Case for Buying

Buying a home still carries strong financial and emotional benefits.

Advantages include:

-

Building equity. Instead of paying rent to a landlord, your mortgage payments build ownership in a property that may increase in value.

-

Stability. You’re not subject to rent increases or a landlord deciding to sell.

-

Personal freedom. Want to renovate the kitchen, add a garden, or finally get that dog? When you own, the choice is yours.

-

Long-term wealth. Real estate has historically appreciated over the decades. In Ontario, even with recent price corrections, long-term owners have generally built significant equity.

The challenges of buying are real, too. Higher interest rates mean monthly payments are much steeper than even two years ago. First-time buyers may also struggle with saving a down payment, especially in competitive urban centres. In Kingston or Napanee, homes under $400,000 are rare, and many buyers are competing for the limited supply.

Running the Numbers

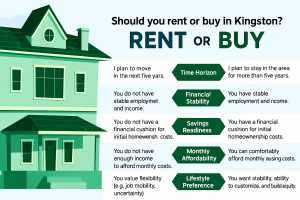

At the end of the day, deciding whether to rent or buy in 2025 comes down to your personal finances and goals. A helpful way to compare is to use a Rent vs. Buy Calculator.

This tool lets you plug in your rent, local home prices, down payment, and mortgage rates to see how the costs stack up over time. In many Canadian cities, buying may only start to “beat” renting after 5–10 years of ownership. For short stays, renting often makes more sense. For those planning to put down roots, buying tends to come out ahead in the long run.

Lifestyle and Personal Goals

Numbers matter, but lifestyle counts too. Do you value freedom and flexibility, or do you crave stability and the pride of ownership? Are you comfortable handling repairs and yardwork, or do you prefer calling the landlord when something breaks?

For some, renting is the right fit for a season of life, while for others, buying is part of a longer-term wealth-building strategy.

___________________________________________________________________________________________________________________________________________________________________

Looking Ahead: How “Future You” Might Feel

Sometimes the best way to make a decision today is to imagine how you’ll feel looking back years from now.

-

Relieved → In 20 years, you’ll likely be grateful you locked in ownership when you did, especially as rents continue to rise in Kingston.

-

Nostalgic → Even if your first home isn’t the dream one, it may become the place where memories are made — and you’ll look back on it fondly.

-

Proud → Buying a home is rarely easy, but decades from now, you may see it as one of your biggest life accomplishments.

-

Wishful → You might even wish you had stretched for a second property as an investment, given Kingston’s steady growth and rental demand.

Buying a home isn’t just about the numbers today. It’s also about the peace of mind, pride, and sense of stability that “future you” may thank you for.

The Bottom Line

There isn’t a one-size-fits-all answer to the rent vs. buy question. Your income, savings, career plans, and even your personality all play a role.

If you’re wrestling with the decision, talking to a REALTOR® who knows the Kingston and area market can make things clearer. I help clients every day who are weighing these choices—whether they’re saving for a first home, downsizing, or moving into a new neighbourhood.

Let’s sit down, review your options, and make sure your next move—whether renting or buying—fits your goals and your pocketbook.

If you’re working through your budget and wonder what kind of home fits right now, my Match Your Home to Your Budget, 2025

Don’t Miss These Guides:

• Match the Home You Buy to Your Budget

• Hidden Costs of Buying a Home in Eastern Ontario

• Autumn 2025 Kingston Real Estate Market Update