What Kingston Area Buyers Need to Know

Buying a home is not only about what you want. It is about what you can comfortably afford now and in the years to come. A solid budget protects you from surprises and gives you confidence when the right home appears. It is essential to establish a clear budget before starting your home search.

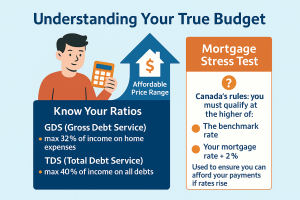

Start with what lenders will look at

Before you tour homes, it’s crucial to understand how lenders determine affordability. They survey your Gross Debt Service and Total Debt Service ratios, which outline how much of your income can go toward housing and overall debt. Establishing a budget that reflects your financial situation will help in this process. Canada’s mortgage stress test also plays a significant role.

The principle behind this idea is to protect buyers in the event of rising rates, but it can also limit the maximum purchase price. A quick conversation with a mortgage professional or an online affordability calculator will provide you with a clear range to work within before you view homes, empowering you to make informed decisions.

Incorporating a budget into your planning can prevent future financial strain. Understanding your budget allows you to focus on homes that truly fit your financial capacity.

💡 Pro Tip: Use the CMHC mortgage affordability calculator to get a realistic view before meeting with your bank or mortgage broker.

Plan for the next three to five years.

Affordability is not only about today’s income. It is also about how your life may change. Think about any shifts in your work schedule, income, or family plans as you create your budget. It is also realistic to prepare for everyday surprises, such as car repairs or unexpected increases in insurance costs. A home that gives you breathing room is more sustainable than one that stretches your budget to the limit.

-

Think ahead — your home should work for you today and adapt to your tomorrow.

Look for long-term value.

It is easy to become excited by finishes and décor, but long-term value comes from strong fundamentals. Neighbourhoods with steady demand, layouts that suit different stages of life, and properties with room for improvement all provide better support. Homes near schools, parks, transit, and essential services hold their value more consistently than those without these features.

When assessing long-term value, it is critical to align your choices with your budget to ensure you make a wise investment.

A home that is versatile and well-located is more likely to protect your investment through changing market conditions.

Kingston and the surrounding communities

The Kingston area is in a balanced market, offering buyers more time to think and more room to negotiate. Prices have leveled off in many neighborhoods. This provides opportunities for buyers who felt excluded during the swift COVID-era seller’s market. In communities such as Verona and Harrowsmith, larger lots and quieter streets offer good value. Westbrook and Cataraqui Woods remain family-friendly and conveniently close to major shopping areas. Downtown Kingston provides walkability and heritage charm, but homes in this area cost more.

In balancing your options, always refer back to your budget to guide your decisions in this market.

Nearby communities, such as Napanee, Stone Mills, and South Frontenac, are excellent options for first-time buyers, retirees, and those who enjoy more space and nature. With more inventory available, buyers can negotiate closing dates, inclusions, and repairs with greater confidence, creating a stable market for your home-buying journey.

________________________________________________________________________________________________________________________

Spotlight on Affordable Neighbourhoods for First-Time Buyers

Kingscourt: A First-Time Buyer Favourite

Kingscourt has long been one of Kingston’s most accessible neighbourhoods for entry-level buyers. Locals know the area for its mix of small detached homes, bungalows, and duplexes, and buyers often find these properties under the citywide average price. For young professionals or families entering the market, Kingscourt offers value without compromising location. You’re close to downtown, Queen’s University, and major transit routes, while still enjoying a strong sense of community. The neighbourhood has been gradually revitalizing, with homeowners investing in upgrades and infill builds, adding new life to the streetscape. For buyers seeking a balance of affordability and long-term potential, Kingscourt remains a smart place to build equity.

Considering the budget is vital when searching for a home as it ensures you remain within your financial limits.

Rideau Heights: Affordable and Changing Fast

Once overlooked, Rideau Heights is becoming one of Kingston’s most talked-about affordable neighbourhoods. Thanks to a city-led redevelopment plan, the area is seeing improvements to infrastructure, housing, and community amenities. For first-time buyers, this is good news: homes here often list at a lower entry price compared to other parts of Kingston, but the long-term upside is stronger now than ever. Those who might otherwise find themselves priced out can own a home because compact homes and townhouses are available at approachable prices. With new green spaces, updated roads, and improved transit links, Rideau Heights is moving from a “hidden gem” to a neighbourhood in transition—an appealing option for buyers willing to see the potential.

As you explore these areas, maintaining a focus on your budget will help you make informed choices in a rapidly changing market.

Rural Communities: Space and Affordability Beyond the City

For buyers willing to look just beyond Kingston, rural communities like Verona, Harrowsmith, and Napanee provide some of the best budget-friendly options in 2025. Here, your money provides greater value: larger lots, detached homes with room to grow, and even hobby farms sometimes appear at or below the price of smaller city homes. Rural living means trade-offs—longer commutes, fewer walkable amenities—but for many first-time buyers, the lifestyle benefits are worth it. Families appreciate the extra space for children and pets, while nature lovers enjoy the lakes, trails, and slower pace. As Kingston expands outward, these communities are becoming increasingly attractive to those seeking affordability and space.

When weighing rural options, ensure your budget aligns with the potential costs of travel and living outside the city.

Work with professionals who protect your interests.

A good REALTOR® brings more than neighbourhood knowledge. They help you narrow your true price range, explain how local trends affect long-term value, and introduce you to mortgage professionals who can give you clear guidance. Furthermore, they aid in negotiations, making sure the terms are in line with your financial plan and goals. Most importantly, they help you spot issues that could lead to higher costs in the future. Their guidance and support make every part of the process easier and more predictable, giving you the confidence that you’re making the right decisions.

Utilising the expertise of professionals can help you navigate the complexities of budgeting in the real estate market.

________________________________________________________________________________________________________________________

Frequently Asked Questions

How much should I budget for closing costs?

Closing costs in Ontario typically range from 2% to 4% of the purchase price. The range includes land transfer tax, legal fees, adjustments, and insurance. First-time buyers may qualify for rebates that reduce the total.

Should I wait for interest rates to drop?

When considering your options, always return to your budget to determine the best path for your financial future.

Lower rates can help, but timing the market is a challenging endeavour. A balanced market offers buyers more choice and negotiation room at present. The best time to buy is when a home aligns with both your income and lifestyle.

How do I know if a neighbourhood will hold its value?

Neighbourhoods with steady sales activity, accessible transit, schools, parks and ongoing investment tend to remain strong over time. These fundamentals often matter more than cosmetic features.

Financial goals should dictate budget impacts of potential home choices.

Are rural homes riskier to buy?

Rural homes can offer excellent value, but they require more due diligence. Wells, septic systems and heating setups vary, so it is essential to work with a home inspector who understands rural properties.

Is renting smarter this year?

It depends on your timeline. Renting may be the better choice if you expect to move again within one or two years. If you plan to stay for at least 3 to 5 years, owning can provide stability and the opportunity to build equity.

If you find your budget stretched too thin during the home-buying process, choosing to rent may be the better option.

-

Don’t Miss These Guides:

•Home Inspections: Benefits for Buyers and Sellers - A clear look at what a home inspection covers, how to interpret the findings, and how the results can influence negotiations. Useful for buyers who want protection and for sellers who want fewer surprises.

-

• Neighbourhoods in Kingston and the Area

-

An overview of Kingston and surrounding communities, from established urban areas to rural and waterfront settings. Reviews lifestyle factors, commute patterns, amenities, and how neighbourhood choice affects long-term value.

• Hidden Costs of Buying a Home in Eastern Ontario -

Besides the sale price, buyers need to set aside funds for: closing costs, land transfer tax, inspections, insurance, legal fees, adjustments, and upkeep. This guide outlines the numbers so there are no unexpected financial surprises.

• Kingston Homes: To Rent or To Buy, 2026 - A balanced look at the financial and lifestyle considerations of renting versus owning in today’s market. Reviews local trends, equity building, flexibility, and long-term planning to help you decide what makes sense for your situation.

Purchasing a home in Kingston means selecting a lifestyle that matches your finances and guarantees long-term financial stability. When you are ready to take the next step, I can help you find a home that supports your plans and keeps your finances steady for the years ahead.

In the end, your success in finding a home in Kingston in 2025 depends on your budgeting skills for a comfortable living arrangement.

________________________________________________________________________________________________________________________

🔗 Helpful Resources

-

Mortgage Affordability Calculator (Ratehub.ca)

Estimate how much home you can afford based on income, debt, and down payment. -

Home Buyers’ Plan (RRSP Withdrawal Info)

Learn how to withdraw up to $30,000 tax-free from your RRSP in 2025 to use as a down payment, and understand repayment timelines. -

Ontario Land Transfer Tax Calculator

Calculate land transfer tax costs and rebates for first-time home buyers in Ontario.HUnderstanding the implications of your budget will help you navigate the intricacies of the real estate landscape.