What Kingston area homeowners need to know

Reverse mortgages are becoming more visible throughout Kingston and the surrounding communities. Rising home values have created significant equity for many seniors, while increasing living costs have made cash flow more difficult. A reverse mortgage can seem like an easy solution, but it can also become a trap when the long-term costs are not fully understood.

Many homeowners do not realize how quickly interest compounds, causing the debt to grow faster than expected and significantly draining their home equity over time. Understanding this helps you see the actual long-term costs and avoid surprises.

What a reverse mortgage is

A reverse mortgage is a loan secured against your home and available to Canadians aged 55 or older. You continue to own the home and live in it, but you do not make monthly payments. Interest is added to the balance each month. The loan must be repaid when you sell the home, move permanently, or pass away.

Most lenders allow access to a portion of your equity, often up to about 55 percent of the home’s value.

How it works

Approval is based on your age, the market value of your property, where the home is located, and the current interest rate environment. Older borrowers qualify for higher amounts because lenders expect shorter borrowing periods.

The funds can be taken all at once or drawn as a monthly income. Since there are no required payments, the interest compounds, which means the balance grows a little faster every month. When repayment is finally triggered, the amount owing is calculated based on the home’s current market value, not the value on the day you signed.

One protection is the no-negative-equity guarantee. If the home’s value drops and the loan exceeds the sale price, the lender absorbs the difference. Your family is not responsible for the shortfall.

The good parts

For many seniors, the main advantage is the ability to stay in their homes while accessing tax-free funds. The money does not affect government benefits such as OAS or GIS, and it can be used for anything from medical care and mobility upgrades to heating system replacements or debt consolidation.

Reverse mortgages do not require income or credit approval, which helps seniors who no longer qualify for traditional products. They do not require monthly payments either, which can make day-to-day living easier for homeowners on a fixed income.

The reverse mortgage trap

The problem is that most borrowers underestimate how quickly interest grows when no payments are being made. After several years, the loan can take a larger share of the home’s equity than expected. Penalties for early repayment can also be steep, and once a reverse mortgage is registered on title, other financing options become very limited.

The situation becomes even riskier when property taxes, home insurance, or maintenance fall behind. A reverse mortgage lender can demand full repayment if any of these obligations lapse; this is one of the most common reasons seniors run into trouble, and it can force a sale of the home sooner than planned.

The advice to seek independent legal counsel ensures seniors feel supported and reassured that their interests are protected before taking action.

The costly side

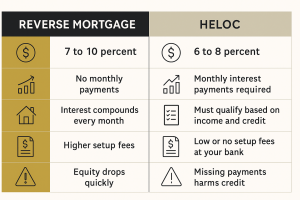

Reverse mortgages carry higher interest rates than mortgages, refinances, or HELOCs. In Canada, the rates typically range from 7 to 10 percent. There are also appraisal, administrative, and legal fees, as well as penalties if the loan is paid off early.

The balance grows every month because interest compounds. The longer the loan remains active, the faster the balance increases, which can significantly reduce the inheritance left to your children or your estate.

Interest rates compared with HELOCs

The closest comparison for most homeowners is a HELOC (Home Equity Line of Credit). HELOCs are usually issued through your own bank. They require income and credit qualification, but the rates are typically far lower, often at prime plus a small percentage. In late 2025, that usually means between 6 and 8 percent.

The cost difference over several years can be substantial. HELOCs require monthly interest payments, whereas reverse mortgages do not, which is why their rates and fees are higher.

Scams and risks in Kingston and surrounding communities

The rise in reverse mortgages has led to an increase in scams. Some scams involve fake lender letters or fraudulent refinancing documents. Others hide behind online calculators designed to gather personal information. There have also been cases where contractors push seniors toward reverse mortgages to pay for renovations, which is a major red flag.

Pressure from acquaintances, caregivers, or distant relatives is another concern. Independent legal advice is essential, and so is taking time to understand every term.

Misleading sales calls also occur. Some representatives gloss over penalties or long-term costs and focus only on the immediate cash. Always ask for written details and bring a trusted family member to meetings.

When a reverse mortgage may help

A reverse mortgage can make sense when a homeowner wants to remain in their home long term, does not qualify for a HELOC, and needs reliable access to funds for health care, accessibility, or significant repairs. It can also help homeowners who have no heirs or whose heirs are unwilling to use the home’s equity now.

When a reverse mortgage can cause problems

It is rarely a good idea for anyone planning to move, downsize, or sell within a few years, or for anyone whose home needs significant repairs. If you’re concerned about keeping up with taxes or insurance, or want to leave an inheritance, a reverse mortgage may not be the best choice. Recognizing these signs helps you make safer decisions.

How to protect yourself or your parents

Entering a reverse mortgage should always involve a review with an independent lawyer and a comparison of all options, including HELOCs, refinancing, downsizing, or provincial support programs. By reviewing the options, you can choose the most suitable and cost-effective solution for your situation.

Even making occasional voluntary payments can slow the long-term interest growth and preserve more equity.

Frequently asked questions

Is a reverse mortgage a good idea?

It depends on income, long-term plans, and the ability to maintain the home. It can help with cash flow, but the long-term cost is high.

What happens if I fall behind on property taxes or insurance?

The lender can demand full repayment, which is one of the most serious risks and should be considered before signing.

What value is used when the loan ends?

The current market value at the time of repayment or sale, not the value from the day the paperwork was signed.

How much can I borrow?

Often up to about 55 percent of the home’s value.

What does HELOC mean?

HELOC stands for Home Equity Line of Credit. It is a revolving line of credit secured by your home.

Is a HELOC usually through the banks?

Yes. Your personal bank or credit union is most often the one that issues HELOCs.

Why choose a HELOC instead?

Lower interest rates, lower fees, and more flexibility. They are the better choice when income and credit allow.

Can I make payments on a reverse mortgage?

Yes. Voluntary payments are allowed and slow the growth rate of the balance.

What happens when I pass away?

Your estate must repay the balance, usually by selling the home.

Don’t miss these guides:

Relocating to Kingston and Area 2026

Home Inspections, Benefits for Buyers and Sellers

Top 10 Kingston Home-Selling Tips for 2026