Planning to become a home buyer? As a home buyer, you will almost certainly hear the terms pre-qualified and pre-approved used as if they mean the same thing. They do not. The distinction between them affects how confidently you shop, how strong your offer appears, and how smoothly the transaction unfolds once you find the right property.

Preparation is key in Canada, especially in markets like Kingston and Eastern Ontario, where conditions can fluctuate between balanced and buyer-leaning. Financing clarity early in the process prevents stress later.

Every home buyer should know the financing landscape before beginning their search.

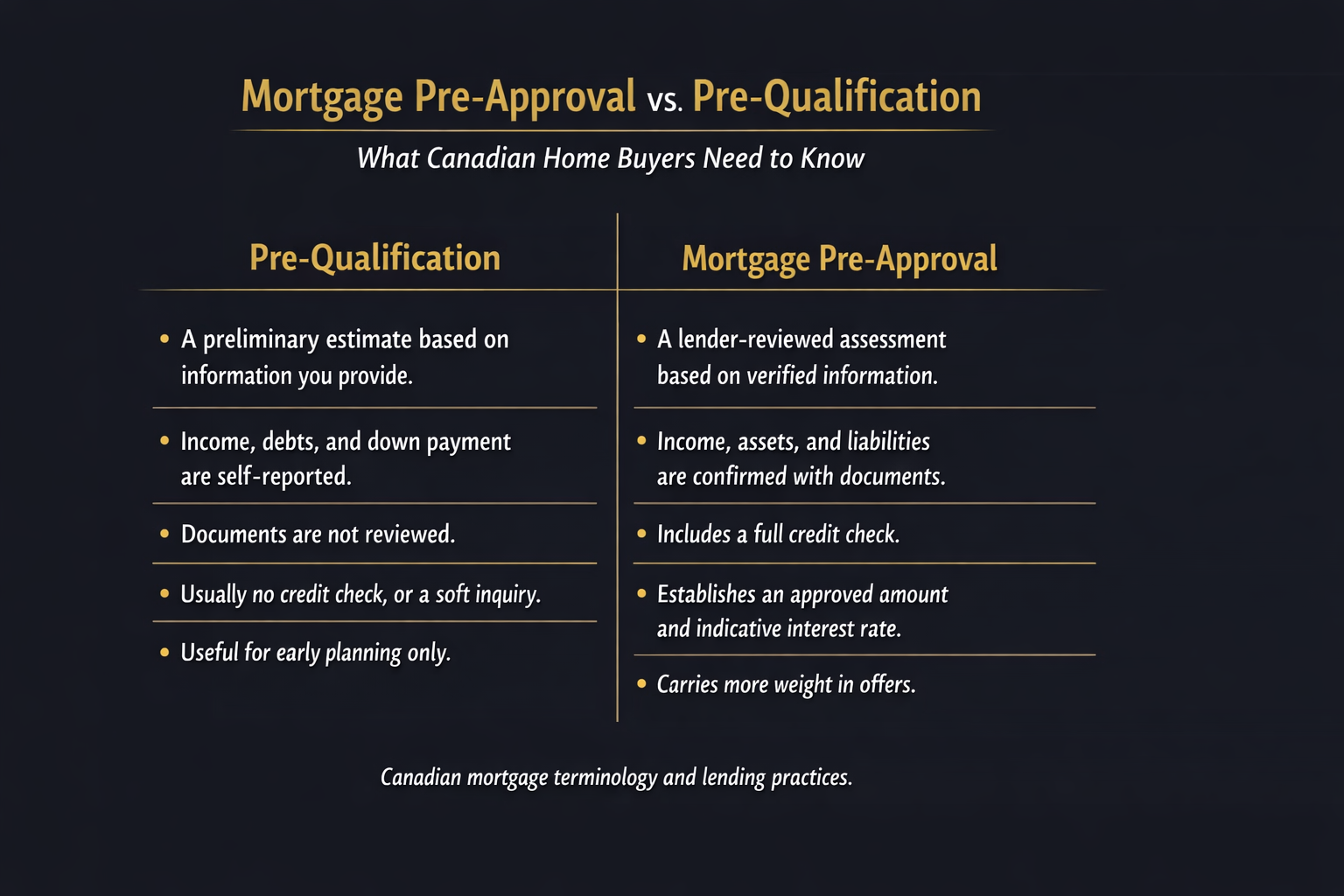

The true meaning of prequalification.

A mortgage pre-qualification is typically an initial estimate of what a home buyer might borrow. It is based on information you provide yourself. You may enter that information into an online calculator or share it during a brief conversation with a lender or mortgage broker.

Income, debts, and down payment details are usually self-reported at this stage for a home buyer. Reviewing supporting documents is often not a practice. Many times, there is no full credit check. Some lenders may perform a soft inquiry, but that is not the same as a full credit assessment.

Because limited verification was involved, people should view pre-qualification as a starting point for a home buyer discussion. It helps establish a rough price range and can provide useful perspective when you browse listings. Lenders do not commit to lending based on it, nor does it confirm financing approval upon offer for the home buyer.

Sellers and listing agents understand this distinction. A buyer relying only on pre-qualification is still early in the financing process.

Understanding mortgage preapproval.

You can’t overstate how crucial preparation is for a home buyer. A smooth financing process can lead to a successful purchase.

A mortgage pre-approval goes significantly further. This is where a lender or mortgage broker reviews verified financial information to determine what they are prepared to lend based on documented evidence.

Income confirmation is now in the lender’s possession for the home buyer. The team examines assets and down payment sources. A full credit report is pulled and analysed. Existing liabilities factor into debt service ratios. They reviewed employment stability. The lender assesses not only gross income but also how sustainable and reliable that income is for the home buyer.

The result is a conditional approval for a specific borrowing amount. Lenders can typically hold an interest rate for a defined period, often between 90 and 120 days. That rate hold can provide protection if rates rise while you are shopping.

It is important to remember that even a pre-approval is conditional for the home buyer. Final approval depends on the property meeting lender guidelines and the borrower’s financial situation remaining consistent.

Not all pre-approvals are equal

One area that causes confusion is the varying depth of review between lenders. Automated systems generate some pre-approvals by relying heavily on uploaded documents and algorithmic checks. Others involve a more detailed manual review by an underwriter.

For buyers with straightforward salaried employment and a clean credit history, either approach may work smoothly. However, for self-employed buyers, individuals with commission or bonus income, buyers using gifted down payments, or those purchasing at higher price points, the level of scrutiny can matter.

When pre-approval is more complete, surprises after an offer are less likely. Buyers feel more secure when they have to make quick decisions.

In a Kingston market that includes everything from urban infill properties to rural acreages with wells and septic systems, clarity on financing strength is not a minor detail.

For every home buyer, understanding the nuances of the market is crucial for making informed decisions.

Canadian pre-approval: lender criteria

For employed buyers, lenders typically request recent pay stubs and a letter of employment confirming position, income, and length of service. They often review recent T4 slips to confirm historical earnings. Consistency matters.

Self-employed individuals must submit their T1 General tax returns and Canada Revenue Agency Notices of Assessment for the past two years. To evaluate income stability, business financial statements are sometimes necessary.

Lenders also review recent bank statements to confirm income deposits and down payment funds for the home buyer. They may include registered and unregistered investments. Affordability calculations factor in all outstanding liabilities, including credit cards, vehicle loans, student loans, lines of credit, and existing mortgages for the home buyer.

Debt service ratios are central to the decision. Gross income alone does not determine borrowing power. Both obligations and payment history hold the same level of importance.

Credit review and stability

A full mortgage pre-approval includes a complete credit pull. Lenders examine payment history, credit utilization, outstanding balances, and the length of credit history. Multiple recent inquiries or missed payments can affect the outcome.

Lenders may request additional documentation from buyers who have recently changed employment, moved frequently, or altered their financial structure. Stability and consistency are key themes in underwriting.

This deeper review gives pre-approval its credibility.

Why does property still matter?

Even with strong pre-approval, the property itself always determines final financing approval. Most lenders require an appraisal to confirm that the home supports the purchase price and meets lending standards.

For each home buyer, knowing how property conditions affect financing is essential.

If a property appraises below the agreed purchase price, the lender may reduce the amount it will finance. The buyer must then increase the down payment or renegotiate the price. Sometimes, the transaction may not proceed.

The condition of the property in question can also affect financing. In rural areas around Kingston and Eastern Ontario, private wells and septic systems must function properly and meet acceptable standards. If documentation is missing or systems are failing, lenders may request remediation before approving funds.

In urban settings, significant foundation movement, major structural concerns, incomplete renovations without permits, or safety hazards can also trigger lender conditions. Even if a buyer is comfortable taking on repairs, the lender may not be.

Financing approval is not based solely on the borrower’s financial strength. It is based on both the borrower and the property.

Why this matters when making an offer

A knowledgeable home buyer is often more successful in negotiations, leading to better outcomes.

From a seller’s perspective, a buyer with a well-documented pre-approval represents lower risk. It signals preparation and reduces uncertainty. When combined with a clear financing condition, it creates a more predictable path to closing.

For buyers, understanding their numbers in advance reduces emotional decision-making. It prevents overextending in competitive moments and minimizes the risk of disappointment after an accepted offer.

In balanced or buyer-friendly markets, it provides negotiating confidence. In tighter markets, it strengthens credibility.

Final thoughts

A prequalification can begin the conversation. A pre-approval moves you closer to action.

In the end, a confident home buyer will be more prepared to handle the intricate process of buying a home.

The difference between the two is not technical language. It is the difference between estimating and verifying. Buyers who understand that distinction early are better positioned to navigate the process calmly and successfully.

If you are considering a move in Kingston or Eastern Ontario, financing clarity is not an afterthought. It is the foundation.

Frequently Asked Questions

Is a mortgage pre-approval the same as final approval?

No. A pre-approval is still subject to conditions, including the specific property, appraisal, and final lender review. Final approval happens after an accepted offer and full underwriting.

How long does a mortgage pre-approval last?

Most Canadian pre-approvals remain valid for 90 to 120 days, depending on the lender.

Will a pre-approval affect my credit score?

Yes. A mortgage pre-approval usually involves a hard credit inquiry, which can have a small, temporary impact on your credit score.

Can a lender decline financing after pre-approval?

Yes. If the property appraises below value, has significant condition issues, or if the borrower’s employment or credit situation changes, financing may be affected.

As a home buyer, it is critical to stay informed about potential changes that could affect financing.

Should I get pre-approved before looking at homes?

Most times, yes. A pre-approval helps you focus on homes you can realistically afford and strengthens your position when it is time to make an offer. If you are unsure if you are capable of a purchase, please s check this article from CHMC

Don’t Miss These Guides

Don’t miss essential information that can empower you as a home buyer in the current market.

First Home Purchase: Kingston Area

A full overview of the Kingston and Eastern Ontario buying process, including financing preparation, offer strategy, inspections, and closing steps

Difference Between a Home Appraisal and a Current Market Assessment

Understanding how lenders determine value compared to how a REALTOR® evaluates market price can prevent appraisal surprises during financing approval.

Purchasing a Fixer-Upper in Kingston and the Area

Older homes, rural properties, and renovation projects can trigger additional lender scrutiny. This guide explains what to consider before making an offer.