The Home Buyers Guidebook for Kingston and Area is designed to walk you through every step of a home purchase; from getting your finances in order, to working with a REALTOR®, to writing an offer, navigating inspections and conditions, and finally, celebrating closing day. Buying a home is one of the most exciting ,and sometimes overwhelming, decisions you’ll ever make. For most people, it represents more than a financial transaction. It’s about finding a place that feels safe, comfortable, and aligned with the life you want to live. Whether this is your very first home, or it’s been many years since your last move, the process can feel full of twists and turns. Along the way, you’ll find local notes for Kingston and surrounding communities like Napanee, Verona, Odessa, and South Frontenac. Because buying here isn’t quite the same as buying in Toronto or Ottawa.

Think of this guide as your roadmap. It’s not a replacement for the legal documents you’ll sign or the professional advice you’ll receive from lenders, lawyers, and inspectors, but it will help you feel confident at each step. My goal is to make sure you know what to expect, what questions to ask, and how to avoid common pitfalls.

This isn’t a checklist. It’s a story of how buying a home really unfolds in Kingston & Area , written in plain English, with the benefit of years of guiding buyers through the same journey.

The Buyer’s Roadmap

Every home purchase follows a path. The details may vary, but the key stages stay the same:

-

Pre-Approval – setting your budget and financing.

-

Search Homes – narrowing down what’s available and what fits.

-

Make an Offer – negotiating terms and price.

-

Inspection & Conditions – due diligence and protection.

-

Closing Day – paperwork, funds, and keys.

-

Move In – making the house your home.

(Insert Roadmap Infographic here)

1. Getting Started: Finances & Pre-Approval

Now you have decided to become a Home Buyer. The first step isn’t opening a real estate app or visiting an open house — it’s getting your financial house in order. Too many buyers start with the fun part (looking at homes) without first knowing what they can comfortably afford.

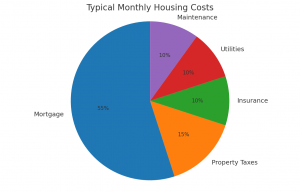

A good rule of thumb is to keep total housing costs, mortgage, property taxes, insurance, utilities, and maintenance, under 30% of your gross monthly income. That number isn’t set in stone, but it’s a healthy guideline that leaves room for savings, unexpected expenses, and lifestyle.

Down payments in Canada can be as little as 5% for a primary residence, but anything under 20% requires CMHC insurance, which adds cost. For some buyers, it makes sense to enter the market sooner with a smaller down payment; for others, waiting to reach 20% saves money in the long run.

The pre-approval is where things get serious. Don’t settle for pre-qualification, which is just a quick calculation. A pre-approval means a lender has looked at your credit, income, and debts and is willing to commit to a mortgage amount (subject to conditions). Having this in hand shows sellers you’re serious and gives you a clear ceiling when house-hunting.

And don’t forget Canada’s mortgage stress test. Lenders will qualify you at the greater of the Bank of Canada’s benchmark rate or your contract rate plus 2%. This can lower the maximum you qualify for, but it protects you if rates rise.

💡 Tip: Start gathering documents early — income statements, pay stubs, tax returns, and ID. Having these ready keeps you one step ahead when your dream home appears.

A typical monthly housing budget breakdown for Canadian homeowners

2. Creating Your Home Wish List

One of the most enjoyable parts of buying a home is letting yourself imagine what life might look like in different spaces. You may find yourself daydreaming about a big backyard barbecue, a cozy reading nook, or finally having a garage where everything has its place. Dreaming is an excellent starting point, but once the process begins, it’s essential to distinguish between what you hope for and what you need. A detailed home wish list will keep you organized and focused in your search.

A wish list isn’t about creating the “perfect” house on paper (because no home ever matches every single dream). It’s about being honest with yourself about what’s essential and what’s extra.

Start with your must-haves. These are the things that make a house truly work for you: the number of bedrooms and bathrooms, whether you need one-floor living, a fenced yard for a pet, or a driveway that can fit two cars. If you regularly work from home, a quiet office space may also fall into this category.

Then, move on to your nice-to-haves. These are features that would make life easier or more enjoyable, but aren’t deal-breakers if they’re missing. An updated kitchen, a finished basement, or energy-efficient windows are all suitable additions.

Finally, think about lifestyle factors. In Kingston & Area, that might mean asking yourself: Do I want a walkable neighbourhood like Portsmouth Village, where I can stroll to a café, or do I see myself in a quieter rural setting like Verona, with more space and privacy? How long am I willing to commute? What schools or services are available nearby? Consider factors like proximity to work, schools, shopping, and recreational activities, as well as the overall feel of the community.

The truth is, even the best house will only give you about 80% of what you want. That’s okay — most homeowners find that once they move in, the things they thought were “must-haves” sometimes turn out to matter less than expected, and other features become more valuable.

📋 House-Hunting Reflection:

- Could I live comfortably here on a day-to-day basis?

- Does the neighbourhood feel right when I visit at different times?

- If I had to compromise, what could I live without?

- Would this house still be a good fit for me three years from now?

Taking the time to create this list now makes the search later far more focused and much less stressful.

___________________________________________________________________________________________________________________________________________________________________

3. Working With a REALTOR®

Buying a home isn’t just about choosing a property; it’s also about navigating contracts, deadlines, inspections, and negotiations. For most people, it’s the most significant purchase they’ll ever make. Having professional representation is not just a convenience, it’s a necessity that empowers you to make those decisions with confidence.

When you choose to work with a REALTOR® and sign a Buyer Representation Agreement (Form 300), you’re not just hiring someone to unlock doors and book showings. You’re entering into a legal relationship where your agent owes you specific duties. These include protecting your best interests, keeping your information confidential, and disclosing any material facts about a property that might affect your decision.

Sometimes, a single brokerage may represent both the buyer and the seller in the same transaction; this is called multiple representation. It’s legal in Ontario, but only if you give informed written consent. In these situations, the brokerage must clearly explain how your interests will be handled, and there are limitations on the type of advice that can be given to each party. It’s essential to ask questions and ensure you’re comfortable before agreeing to this.

You’ll also want to understand how commission works and what’s meant by a holdover clause. These are standard parts of agreements in Ontario, but they’re worth having explained in plain English so there are no surprises.

Beyond the paperwork, REALTORS® in Ontario are regulated by the Real Estate Council of Ontario (RECO); this means your agent has to treat you with honesty, fairness, and integrity. They must avoid misrepresentation, disclose any known issues with a property, and ensure that all agreements are put in writing. In short, there are robust professional and legal safeguards in place to protect you as a buyer, providing you with a sense of security and peace of mind.

Representation is one of the most important — and often least understood — parts of the home buying process. A good REALTOR will not only take the time to explain it clearly but also ensure you understand it fully, answer your questions without rushing, and ensure you feel comfortable before signing anything. This level of guidance ensures you are well-informed and educated throughout the process.

✅ With more than 13 years of helping buyers move in and sellers move on, I’ve had the privilege of guiding clients through this step hundreds of times. My role is to ensure you are aware of your options, understand your rights, and feel confident that someone is looking out for your best interests from the very beginning.

4. The Home Search

This is the stage most people think of when they picture buying a home: driving through neighbourhoods, booking showings, walking through hallways and kitchens, and imagining how life might look inside those walls. It’s exciting — but it can also be overwhelming if you don’t know what to focus on.

The key during the search is to balance emotion with logic. It’s natural to fall in love with a house because of the sunlight in the living room or the charm of an old porch swing. But those feelings need to be paired with clear-eyed questions about the structure, systems, and location.

Look past the décor. Paint colours, furniture, and clutter are temporary. What matters are the bones of the house — the foundation, the roof, the windows, and the mechanical systems. These are the expensive items, and they will affect your comfort and your budget far more than whether the seller likes floral wallpaper.

Check the neighbourhood. A house doesn’t exist in isolation. Walk the street. Visit at different times of day. See what traffic, noise, and lighting are like in the evening compared to the afternoon.

Morenz Crescent in Kingston’s Rideau Heights is a good example of a typical suburban street. Homes here reflect the city’s mid-century building boom, offering practical layouts on mature lots. Rideau Heights is also one of Kingston’s more budget-friendly neighbourhoods, making it an attractive option for first-time buyers or anyone looking to maximize value while still staying within city limits.

Be ready to act. In Kingston & Area, desirable homes can sell quickly. If you hesitate too long, another buyer may scoop it up. Having your pre-approval and deposit funds ready gives you the confidence to make an offer when the right place appears.

5. Making an Offer

Having found a house that resonates with you, it’s time to formalize your interest. This stage can be emotionally charged, but it’s also where the invaluable support of a professional comes into play, providing you with the reassurance and confidence you need.

An Agreement of Purchase and Sale (Form 100) is more than just a price tag. It’s a detailed contract that outlines the rights and obligations of both the buyer and the seller. Typically, it will include:

- Purchase price and deposit. In Kingston & Area, deposits often range from $5,000 to $20,000, though higher amounts may be expected in competitive situations or on higher-value properties. Deposits are held in trust, providing security to both parties.

- Conditions. These are clauses that protect you as the buyer, such as financing, home inspection, or review of the status certificate for condos.

- Inclusions and exclusions. Appliances, window coverings, or outdoor items, such as sheds or play structures, may be included or excluded. It’s always best to put these in writing rather than relying on verbal agreements.

The closing date is a crucial milestone in the homebuying process. It’s the point at which ownership officially transfers, and you receive your keys. It’s essential that this date aligns with your lender and lawyer’s timelines, ensuring you’re fully prepared for the next steps.It’s easy to get caught up in the asking price, but remember: list price is a strategy, not a guarantee of value. Sellers may list at a high, low, or right on target, depending on market conditions. Your REALTOR® will prepare a Comparative Market Analysis (CMA), comparing recent sales in the area to provide you with a realistic sense of fair value.

Negotiation is not about “winning” at all costs. It’s about finding terms that work for both parties so the deal can move forward. A very low offer can sometimes backfire, making the seller less willing to negotiate. A fair offer, supported by data, demonstrates your seriousness and increases your chances of a successful outcome.

💡 Tip: Always ensure you fully comprehend the implications of making your offer ‘firm’ (with no conditions). While it may make your offer more appealing, it also removes crucial protections. Discuss the risks with your REALTOR® before making this significant decision, empowering you with the knowledge you need.

6. Inspections & Conditions

An accepted offer doesn’t mean the process is over. In many ways, this is where the real due diligence begins.

A home inspection is one of the smartest investments you can make. A professional inspector will examine the property’s major systems and components: the foundation, roof, plumbing, electrical, heating and cooling, insulation, windows, and more. While it’s not invasive, inspectors don’t open walls , it provides a valuable overview of the home’s condition and potential issues.

In Kingston & Area, there are also specialist inspections that are often worthwhile. Rural homes may require septic and well inspections to ensure safe water and a properly functioning system. If the house has a wood-burning appliance, a WETT inspection is recommended. Older homes may need checks for aluminum wiring or asbestos insulation.

Conditions protect you as a buyer. A financing condition ensures your lender approves the mortgage. An inspection condition provides you with the opportunity to walk away or renegotiate if significant issues are discovered. These conditions must be in writing and must include clear deadlines; otherwise, their protection may not be upheld.

Remember: sellers and agents are required to disclose material facts they know about the property. But not every issue is visible, which is why inspections remain essential.

👉 Related: Home Inspections: What Buyers Need to Know

7. Closing the Deal

After conditions are satisfied and the offer becomes firm, you’re on the home stretch, but there are still essential steps before you get the keys.

During this phase, your lawyer plays a pivotal role. They will conduct a title search to ensure there are no liens or claims on the property, prepare the closing documents, manage the transfer of funds, and register the property in your name, ensuring a smooth transfer of ownership.

Another key player in the closing process is your lender. They will finalize the mortgage, but this can only happen once they receive proof of home insurance. It’s important to arrange this well in advance of closing day to prevent any delays.

Before you receive the keys, you’ll usually conduct a final walkthrough; this is a crucial step that gives you the opportunity to confirm that the home is in the agreed-upon condition, that inclusions are still present, and that nothing has changed since you last saw it. This walkthrough is designed to give you peace of mind and ensure everything is as it should be.

📦 Moving Checklist:

- Book movers early and confirm details.

- Set up utilities, internet, and cable in advance.

- Forward your mail and update your address with banks, insurance companies, and government agencies that require your ID.

Closing day is a significant milestone in your homebuying journey. It can feel both nerve-wracking and exciting. Once funds are transferred and the lawyer confirms registration, the keys are released. That’s when the house officially becomes your home, marking the end of a long process and the beginning of a new chapter.

8. Common Buyer Mistakes to Avoid

Home buyers often make small missteps along the way, but some mistakes can be costly. The good news? Most of them are easy to avoid once you know what to watch for.

One of the biggest is shopping before pre-approval. It’s tempting to start scrolling through listings or even booking showings before talking to a lender. But without a pre-approval, you risk falling in love with a home outside your price range, or worse, missing out on a property because your financing isn’t ready.

Another common pitfall is letting first impressions cloud judgment. It’s easy to be swayed by staging, paint colours, or furniture. Remember: décor can change, but things like roof age, wiring, and water systems can’t be fixed with a weekend project.

Some buyers are tempted to skip the inspection to make their offer more appealing. This can be one of the most expensive mistakes of all. Even if a home looks immaculate, an inspection can uncover hidden issues like leaks, insulation gaps, or structural problems.

Other avoidable errors include:

-

Not reading your contracts carefully. The Agreement of Purchase and Sale and Buyer Representation Agreement contain legal obligations. Make sure you understand what you’re signing.

-

Waiting too long to arrange insurance. Your lender requires proof of insurance before closing, and scrambling at the last minute can cause delays.

-

Over-negotiating. Coming in far below market value can sour negotiations and close doors instead of opening them.

Learning from others’ mistakes is one of the best ways to keep your own journey smoother and less stressful.

9. Thinking Long-Term

Being a home buyer isn’t just about solving today’s needs. It’s about investing in your future.

One of the biggest advantages of homeownership is equity growth. Every payment you make reduces your mortgage balance and builds your stake in the property. The longer you stay, the more equity you build.

It’s wise to think about resale appeal even as a buyer. Location and layout often matter more to future buyers than cosmetic finishes. A smaller home in a sought-after Kingston neighbourhood may appreciate more than a larger home in a less desirable location.

Also consider future flexibility. If you need to relocate down the road, could you rent out the property rather than sell? In some markets, this option makes financial sense and gives you time to wait for the right conditions to sell.

💡 Tip: Plan for a minimum of three to five years in your first home. That time frame allows you to build equity and recover transaction costs before moving again.

10. Paying Down Your Mortgage Faster

As Home buyers, your mortgage is likely the largest debt you’ll ever take on , but it doesn’t have to be one you carry for the full 25 years. Small, consistent strategies can help you pay it off faster and save thousands in interest.

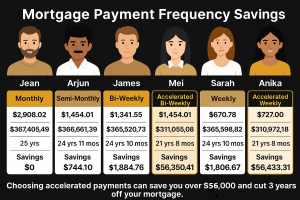

One of the simplest methods for you, the home buyer, is choosing accelerated bi-weekly payments instead of monthly. This results in the equivalent of one extra monthly payment each year, chipping away at your principal without a dramatic change in your budget.

Another option is to increase your regular payments. Even adding $50 or $100 each time goes straight toward the principal, cutting years off your amortization.

Many lenders also allow annual lump-sum payments of up to 10–20% of your original mortgage balance without penalty. Using tax refunds, bonuses, or extra savings for a lump sum can make a noticeable dent.

Finally, don’t be afraid to shop around. Mortgage brokers can often find better rates and more flexible prepayment options than a single bank can offer.

-

On a $500,000 mortgage at 5%, choosing accelerated payments can save you over $56,000 and cut more than 3 years off your mortgage

11. FAQs

What is a Home Buyers Guidebook?

A Home Buyers Guidebook is a step-by-step resource that explains the full home buying process. This guide is tailored for Kingston & Area, so buyers here understand local neighbourhoods, financing, offers, and closing with confidence.

When is the best time to buy a home?

There’s no one-size-fits-all answer. In Kingston, spring and fall see the most listings, but the right time depends on your personal finances and readiness to be a home buyer.

How much deposit do I need?

Typically between $5,000 and $20,000 in Kingston & Area, depending on the price of the home and competitiveness of the offer. Higher-value homes or bidding wars may require more.

Do I need an inspection on a new build?

Yes. Even brand-new homes can have construction issues. An inspection provides peace of mind.

What does a lawyer do at closing?

Your lawyer protects your legal interests, reviews the title for issues, prepares documents, and ensures funds are properly transferred.

What if I have a concern about my REALTOR® or transaction?

You have the right to raise concerns with your brokerage and can contact the Real Estate Council of Ontario (RECO) for consumer protection.

Final Thoughts

Buying a home is rarely a straight line. There are moments of excitement, stress, and sometimes disappointment — but also the satisfaction of knowing you’ve made a decision that shapes your future.

The right house isn’t necessarily the perfect one. It’s the one that fits your needs, your budget, and your lifestyle, while giving you room to grow.

As your Kingston-area REALTOR®, I’m here to walk with you every step of the way. From the first conversation about your budget to the moment I hand you your keys, my role is to make the process clearer, less stressful, and ultimately more rewarding.

📞 Bill Stevenson, REALTOR® – Century 21 Lanthorn Real Estate

📧 realtorbill76@gmail.com | ☎ 613-449-2630