You’re ready to be a first-time buyer! Buying your first home is one of the most significant financial decisions you will ever make. It is exciting, emotional, and often overwhelming, especially if you are trying to figure it all out while juggling work, rent, and day-to-day life. I bought my first home in 2003, and while prices, interest rates, and regulations have changed, many of the same mistakes still trip buyers up today.

What has changed is the Kingston-area market. In 2026, first-time buyers are dealing with higher borrowing costs than they were used to just a few years ago, limited entry-level inventory, and more complex decisions about where and how they want to live. Condos, townhomes, older city houses, rural properties, and newer subdivisions all come with very different trade-offs.

After working with first-time buyers across Kingston, Amherstview, Gananoque, Napanee, and surrounding communities, I see the same issues come up again and again. The good news is that most of these mistakes are avoidable with the proper preparation and realistic expectations.

Here are the most common first-time buyer mistakes I see locally, and how to avoid them.

1. Underestimating closing costs

Many first-time buyers focus entirely on the purchase price and forget that buying a home involves more than just the down payment. In Ontario, closing costs typically range from about 1.5 percent to 4 percent of the purchase price, depending on the type of property and location.

In the Kingston area, closing costs often include land transfer tax, legal fees, title insurance, adjustments for property taxes or utilities, and moving expenses. Buyers purchasing within the City of Kingston may qualify for a first-time homebuyer land transfer tax refund, but it rarely covers the full amount.

Budget for closing costs early and confirm the numbers with your lender and lawyer before you write an offer. This will help first-time buyers feel more confident and less overwhelmed by the process.

2. Waiting too long to check your credit

Your credit history plays a significant role in your mortgage approval, interest rate, and overall borrowing power. I still see buyers fall in love with a home before realizing there is an issue on their credit report that could have been fixed months earlier.

Check your credit well before meeting with a mortgage broker or bank. Addressing errors or missed payments early can give first-time buyers a sense of control and reduce stress during the process. You can check your credit with Equifax or TransUnion, for example.

Once you start the mortgage process, avoid taking on new debt. That means no new car loans, furniture financing, or large purchases until after you have closed on your home.

3. Falling in love with the house and ignoring the neighbourhood

Not researching the neighbourhood is one of the biggest mistakes first-time buyers make in Kingston.

It is easy to fall for a renovated kitchen, trendy finishes, or a freshly staged interior. But you are not just buying a house. You are investing in a street, a neighbourhood, and a long-term environment. Research local amenities, future development plans, and the community vibe to ensure they align with your lifestyle and goals.

Things like traffic, parking, nearby rentals, noise, proximity to schools or amenities, and future development all matter. Researching these will help first-time buyers feel more secure about their long-term investment in Kingston neighbourhoods.

A modest house on a strong street will almost always hold its value better than an over-improved home in a weaker location. Years ago, when I was taking the Real Estate course, I remeber an instructor stressing it is better to have the worst house in a good neighbourhood than the best one in a bad neighbourhood; this becomes especially important if you plan to move again in five to seven years.

4. House hunting without a mortgage pre-approval

Shopping for a home without mortgage pre-approval is like shopping without knowing your budget.

A pre-approval helps you understand what you can realistically afford and what your monthly payments might look like. In competitive price ranges, it also signals to sellers that you are serious and prepared.

In Kingston, entry-level homes and well-priced condos often attract multiple offers. Having pre-approval in place lets you move confidently when the right property comes along, rather than scrambling at the last minute.

5. Buying at the maximum the lender approves

Just because the bank/mortgage broker says you can borrow a certain amount does not mean you should. Consider your monthly expenses, savings goals, and lifestyle needs to set a comfortable budget that prevents financial stress and housing poverty.

Mortgage approvals do not take lifestyle into account. They do not know how much you spend on travel, hobbies, childcare, or simply enjoying your life. Stretching to the maximum can leave you feeling house-poor and stressed, especially if interest rates or other costs increase.

In 2026, savvy buyers leave room in their budget for maintenance, repairs, and unexpected expenses. A comfortable home is one you can afford without constantly worrying about money.

6. Choosing finishes over function

First-time buyers often focus on what a home looks like today rather than how it will work over time.

Paint colours, countertops, and flooring can all be changed. Layout, ceiling height, storage, and room sizes cannot. I encourage buyers to think about where they might be in five or six years. Will the space still work if your life changes?

Adding square footage later is expensive. Buying a functional layout from the start is often the more affordable long-term choice, even if the finishes are not perfect.

7. Not having a home inspection

Skipping the home inspection to save money or time is a risky move, especially in Kingston’s older housing stock. Schedule a thorough inspection to identify potential issues, such as aging roofs or outdated wiring, so you don’t face costly surprises after closing.

Saving money or time by not having a home inspection is one of the most expensive mistakes I see.

In competitive situations, some buyers are tempted to skip the home inspection to make their offer more attractive. In Kingston, where much of the housing stock is older, that can be risky. I know it had to be done during the COVID pandemic when all houses were getting multiple offers, but I stressed it was a risk.

Issues like aging roofs, outdated wiring, older plumbing, foundation movement, moisture problems, or heating system concerns are common. A standard home inspection typically costs a few hundred dollars, a small price compared to the cost of unexpected repairs after closing.

In some cases, a pre-offer inspection can be a clever compromise, especially when there is an offer date.

8. Ignoring first-time buyer programs and incentives

Canada offers several programs designed to help first-time buyers, including the RRSP Home Buyers’ Plan and various federal or provincial incentives. Some programs change, pause, or are phased out over time, so it is important to get current advice.

I often see buyers assume they do not qualify or forget to ask altogether. Your mortgage broker, lawyer, and REALTOR® should all be part of this conversation early in the process.

Missing an incentive can mean leaving real money on the table.

9. Looking only at the mortgage payment

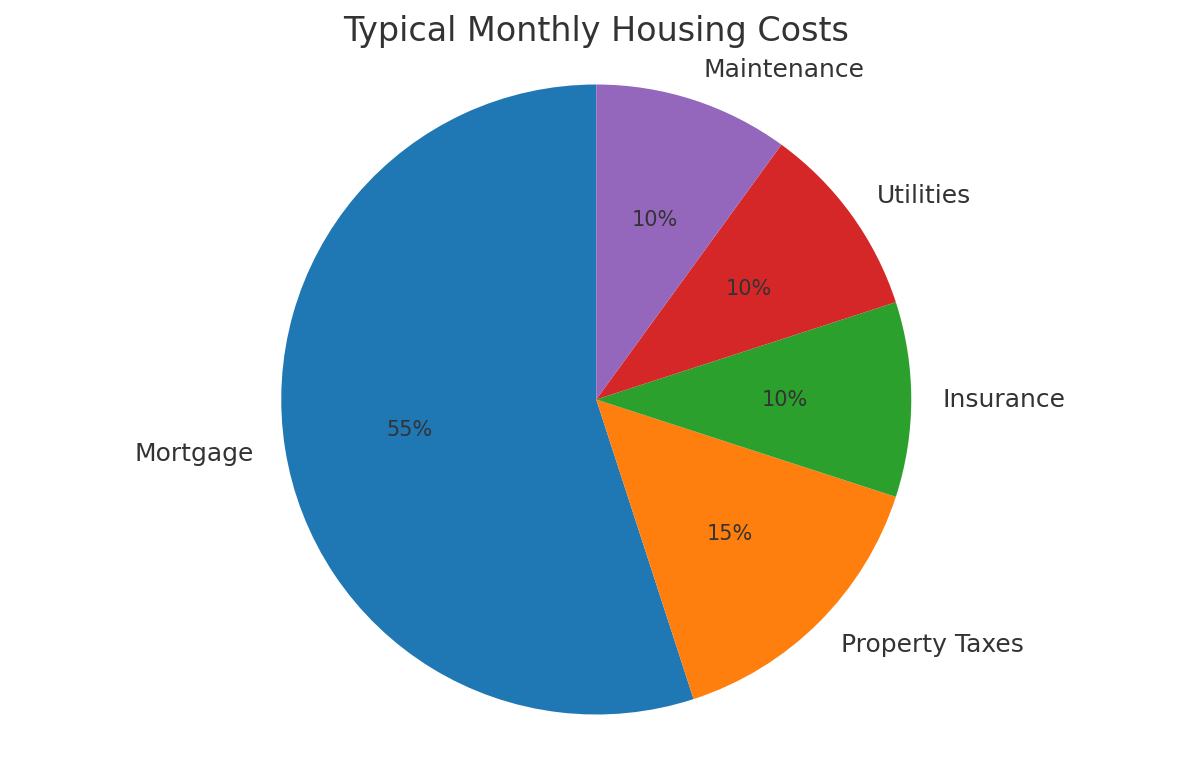

Your housing costs exceed your mortgage payment.

Property taxes, utilities, insurance, maintenance, and seasonal costs all need to be factored in. Those items are essential for buyers looking at rural properties, where well, septic, heating, and snow removal costs can be higher.

In Kingston and surrounding areas, older homes may also require more ongoing maintenance. A realistic monthly budget helps prevent stress and surprises after you move in.

10. Letting emotions take over in multiple-offer situations

Bidding wars still happen in Kingston, particularly in popular price ranges and well-located neighbourhoods.

Before you submit an offer, set a firm maximum price and stick to it. Emotions can run high, especially when you picture yourself living in a home, but overpaying can follow you for years.

Walking away is difficult, but there will always be another opportunity.

11. Ignoring resale value because it feels like a forever home

Even if you plan to stay long-term, resale value still matters.

Life changes. Jobs shift. Families grow. Markets change. Choosing a home with strong resale fundamentals gives you options later, even if you never plan to use them.

Location, layout, and neighbourhood trends matter more than upgrades. Paying a premium for the most expensive home on the street rarely delivers the best return.

12. Underestimating the actual cost of owning a home

Owning a home involves more than making the mortgage payment.

Roofs wear out. Furnaces fail. Driveways crack. Landscaping needs attention. These costs do not arrive on a convenient schedule.

Setting aside an emergency fund protects you from financial stress and allows you to enjoy your home rather than worry about it.

Final thoughts for first-time buyers in Kingston and Area

Buying your first home does not have to be overwhelming, but it does require preparation, honest budgeting, and sound advice. The Kingston market offers a wide range of options, from downtown condos and townhomes to suburban houses and rural properties, each with its own pros and cons.

Avoiding these common mistakes can save you money, stress, and regret. More importantly, it can help you buy a home that fits your life today and still makes sense years from now.

The best time to ask questions is before you write an offer, not after.

Frequently asked questions for first-time buyers in Kingston and Area

How much do first-time buyers need for closing costs in Kingston?

First-time buyers in Kingston should budget 1.5-4% of the purchase price for closing costs. These usually include land transfer tax, legal fees, title insurance, and adjustments for property taxes or utilities. Buyers purchasing within the City of Kingston may qualify for a first-time buyer land transfer tax refund, but it rarely covers all costs.

Should first-time buyers get pre-approved before house hunting?

Yes. A mortgage pre-approval helps buyers understand their realistic price range and monthly costs. In competitive Kingston price ranges, sellers often take pre-approved buyers more seriously, especially when multiple offers are involved.

Is a home inspection still important in competitive markets?

A home inspection remains important, particularly in Kingston, where much of the housing stock is older. Issues related to roofing, wiring, plumbing, foundations, or moisture are common. Skipping an inspection can lead to unexpected repair costs after closing. In some situations, a pre-offer inspection can be a practical alternative.

Are condos a good option for first-time buyers in Kingston?

Condos and townhome-style condos can be a good entry point for first-time buyers, especially those looking for lower maintenance living. Buyers should review monthly condo fees carefully and understand what is included. Location, building condition, and long-term resale appeal still matter.

How much should first-time buyers budget for ongoing home ownership costs?

Beyond the mortgage payment, buyers should budget for property taxes, insurance, utilities, maintenance, and seasonal costs. Older homes and rural properties often require a larger maintenance reserve. A realistic monthly budget reduces financial stress after moving in.

Do first-time buyers need a REALTOR® in 2026?

First-time buyers benefit from guidance on pricing, neighbourhood trends, inspections, negotiations, and conditions. In Kingston’s varied market, professional advice can help buyers avoid overpaying or choosing a property that does not suit their long-term needs.

Don’t Miss These Guides

If you are buying your first home in Kingston or the surrounding area, these guides may also help you plan your purchase more confidently:

-

First Home Purchase: Kingston Area

A step-by-step overview of the buying process, from preparation to closing, with local context. -

Match the Home You Buy to Your Budget: What Kingston Buyers Need to Know

How to align purchase price, monthly costs, and lifestyle so you are not stretched too thin. -

Home Inspections: Benefits for Buyers and Sellers

What inspections cover, when they matter most, and how to use them strategically. -

Relocating to Kingston and Area 2026

A practical guide for buyers moving into the region, including neighbourhood and lifestyle considerations. -

Purchasing a Fixer-Upper in Kingston and Area 2025–26

What first-time buyers should know before taking on renovations or older homes.