Land transfer tax is one of the most significant closing costs for Ontario homebuyers and investors. It is not included in the listing price and is calculated only when a property changes hands. This guide explains how the tax works, how much buyers in Kingston and Eastern Ontario typically pay, how the rules apply to condos, commercial buildings, and vacant land, and how first-time buyer rebates work. A link to the provincial estimator is included for easy calculations. Understanding these differences helps buyers budget accurately for their specific property type.

What is a land transfer tax?

Land transfer tax is a provincial tax charged when ownership of a property is transferred from one owner to another. Buyers pay this tax at closing. The tax applies to most real estate transactions in Ontario, including freehold homes, condos, commercial property, and vacant land.

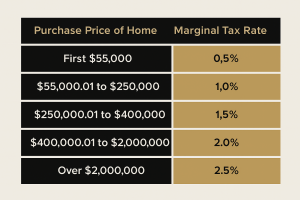

The tax is calculated using a tiered formula. Different portions of the purchase price fall into various ranges, and each portion is taxed separately.

Toronto is the only municipality in Ontario that charges an additional municipal land transfer tax. Buyers in Kingston, Amherstview, Bath, Gananoque, and surrounding areas pay only the provincial tax.

Ontario land transfer tax rates

Ontario uses the following tax bracket structure:

0.5 percent on the first $55,000

1 percent on the portion from $55,000 to $250,000

1.5 percent on the portion from $250,000 to $400,000

2 percent on the portion above $400,000

2.5 percent on amounts above $2,000,000, where the property contains one or two single-family residences

The complete provincial formula is available here:

https://www.ontario.ca/document/land-transfer-tax/calculating-land-transfer-tax

Land transfer tax and commercial property

Commercial real estate purchases in Ontario are also subject to land transfer tax. The structure is almost identical to residential LTT, with one crucial difference.

Commercial, industrial, and multi-residential buildings do not fall under the 2.5% rate, which applies only to one or two single-family residences priced above $2 million.

Below is a simple chart to illustrate how commercial LTT is calculated.

Ontario Commercial Land Transfer Tax Rates

Portion of Purchase Price Commercial LTT Rate

First $55,000 0.5 percent

$55,000 to $250,000 1 percent

$250,000 to $400,000 1.5 percent

Over $400,000 2 percent

These rates apply to:

Retail buildings

Office buildings

Industrial units

Apartment buildings

Mixed-use properties

Airbnb buildings are structured as commercial operations.

Commercial vacant land

Buyers of commercial and vacant land should understand that no rebates apply, so planning for the full land transfer tax is essential for budgeting and peace of mind.

Condos and land transfer tax

Land transfer tax applies to condo purchases even though you are not buying land in the traditional sense. A condominium unit is still considered real property. When you buy a condo, you acquire a registered ownership interest within the condominium corporation, which includes your unit and a proportionate share of the common elements.

As a result, the same provincial tax structure applies to condo purchases as to freehold homes.

Many first-time buyers begin with a condo because the entry price is often lower than that of a detached or semi-detached home. This lower price usually results in a lower land transfer tax, even when monthly condo fees are part of the overall budget. Buyers should still calculate the tax early to avoid surprises at closing.

Vacant land, land transfer tax, and HST

Vacant land purchases in Ontario are generally subject to the land transfer tax. The tax is calculated on the purchase price using the same tiered formula that applies to homes and condos.

The primary source of confusion is HST. Vacant land may be HST-exempt or HST-taxable depending on how many new lots the seller has created. For example, selling one undivided residential parcel is usually HST exempt, but if the seller creates three or more new lots, HST applies to each lot. Clarifying these scenarios helps buyers understand their total tax obligations beyond the land transfer tax.

Selling one undivided residential parcel is usually HST exempt.

Selling two newly created residential lots is usually exempt.

Once a seller creates three or more new lots, the sale is treated as commercial activity for HST purposes. The seller must charge HST on each lot.

So a parcel divided into four new lots becomes subject to HST, with each lot taxed individually. The same parcel would generally have been exempt from HST if sold as one parcel or divided into only two lots.

Land transfer tax still applies in these cases. HST depends entirely on lot creation and the seller’s status under CRA rules.

Land transfer tax is not included in the listing price.

Knowing your land transfer tax in advance helps you plan better and feel more confident at closing, reducing surprises for buyers in Kingston and Eastern Ontario.

Kingston and Eastern Ontario examples

Example 1: $450,000 purchase

0.5 percent of $55,000 = $275

1 percent of $195,000 = $1,950

1.5 percent of $150,000 = $2,250

2 percent of $50,000 = $1,000

Total land transfer tax: $5,475

Example 2: $600,000 purchase

Use the same calculation above for $400,000

2 percent of $200,000 = $4,000

Total land transfer tax: $9,475

Example 3: $800,000 rural or suburban purchase

Use the same calculation above for $400,000

2 percent of $400,000 = $8,000

Total land transfer tax: $13,475

First-time buyer rebates

First-time buyers in Ontario can feel reassured knowing they may qualify for a rebate of up to $4,000, helping them save on closing costs.

Eligibility is strict. To qualify, at least one buyer must:

Have never owned property anywhere in the world

Have never been on the title to any property, including inherited property or property added for estate planning

Occupy the home as a principal residence.

Meet all other program criteria.

This rule catches many buyers by surprise. For example, if a parent adds an adult child to the title of a home for family or estate reasons, that child is no longer considered a first-time buyer and cannot receive the rebate later. To avoid this, buyers should understand the eligibility criteria and plan accordingly. Including a step-by-step overview of rebate application timing and common pitfalls ensures readers can maximize their benefits without unexpected issues.

Use the provincial calculator.

You can test different scenarios using the Ontario estimator:

https://www.ontario.ca/document/land-transfer-tax/calculating-land-transfer-tax

FAQ

Do all property purchases in Ontario require land transfer tax?

Most do. Land transfer tax applies to residential homes, condos, commercial property, and most vacant land. Some narrow exemptions exist under the Land Transfer Tax Act, but they are uncommon in typical real estate transactions.

Does the land transfer tax apply to commercial buildings?

Yes. Commercial, industrial, and multi-residential buildings are subject to land transfer tax at the same rate structure as residential properties, except for the 2.5% rate that applies only to one or two single-family residences priced above $2 million.

Do I pay HST on vacant land?

It depends. A single, undivided residential parcel is usually HST-exempt. Two newly created lots are also typically exempt. When a seller creates three or more new lots, the sale is treated as commercial activity, and HST must be charged on each lot. Land transfer tax still applies in all cases.

Does the land transfer tax apply when buying a condo?

Yes. Even though you do not receive land in the traditional sense, you are still acquiring a registered interest in real property. The same land transfer tax structure applies to condo purchases.

Who pays the land transfer tax in Ontario?

The buyer pays the tax. Your lawyer collects the amount and submits it to the provincial government on closing day, once the transfer is registered.

How much is the land transfer tax on a typical Kingston home?

A $450,000 purchase results in approximately $5,475 in land transfer tax. A $600,000 purchase is about $9,475. The exact amount depends on the price and the provincial bracket system.

Do first-time buyers automatically qualify for the land transfer tax refund?

No. To qualify, you must have never owned property anywhere in the world and must never have been on title, even for estate or family reasons. If your name has ever appeared on a deed, you are not considered a first-time buyer.

Is the land transfer tax included in the listing price?

No. It is calculated separately and must be paid at closing. Buyers should include it in their budgeting early in the process.

Do not miss these guides.

Kingston and Area Home Buyers Guidebook