Your First Home is more than a purchase. It is a step into a new chapter of your life. It is where you begin to build routines, find comfort, create space for the people who matter to you, and put down a foundation that grows with you over time. For many, it is the most significant investment they have made so far. It is normal to feel excitement and caution at the same time. Investing in your first home is a thrilling experience.

My role is to help make this feel manageable and steady. You do not need to rush. You do not need to have every answer. What you need is guidance, clear explanations, and someone who is paying attention to the details that matter.

Finding your first home can be a journey filled with emotional highs and lows. Understanding what you want in your first home will make the process smoother.

In Kingston and the surrounding communities, there is no single right way to begin. What matters is choosing a home that suits your lifestyle, your budget, and your pace. This guide is designed to help you understand the landscape and navigate the process with clarity and confidence.

Many first home buyers overlook the importance of location. Choosing the right area can enhance your living experience.

Start With a Financial Foundation That Feels Comfortable

Your first step is deciding on a budget that fits your daily life, not just the maximum amount a lender may approve; this begins with a mortgage pre-approval. A pre-approval is a lender’s conditional commitment that shows your borrowing range and helps guide your search.

Setting a realistic budget is crucial when looking for your first home. It ensures you can enjoy your new space without financial stress.

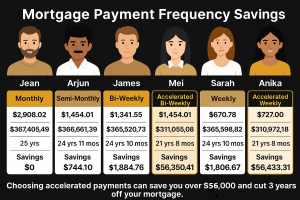

When speaking with your mortgage professional, it is helpful to ask about payment frequency options as well. Most lenders offer monthly, bi-monthly, bi-weekly, accelerated bi-weekly, or weekly payments. The difference is not only in how often the payment comes out. Accelerated payment schedules can shorten the mortgage term and reduce the total interest paid over the life of the loan. Your mortgage professional can help you compare these options and select the structure that best suits your budget and comfort level.

Once pre-approved, try to maintain a steady financial situation. Avoid taking on new loans, going on an extended holiday that interrupts your income flow, making large purchases, or changing jobs before closing; this protects your ability to move forward with your first home purchase smoothly when the right home appears.

When your financing is stable, everything else becomes calmer.

Finding the right financing will help you achieve your goal of owning your first home.

When arranging financing, you are welcome to work with your own bank or any lender you feel comfortable with. Some buyers also find it helpful to speak with an independent mortgage broker to compare rates and terms. Here are several mortgage professionals in the Kingston area who have experience working with first-time buyers:

Fred Cooke (613) 985-0945 Fred@ktownmortgages.ca

David Lloyd 613.449.0579 David@greatratemortgages.com

Karen Matthey 613-893-4139 Karen@mtgprof.com

Condos: A Simpler First Step For Your First Home

The right choice for your first home can set the tone for your future. Many find that starting with a condo is the best way to enter homeownership.

When considering condos for your first home, think about your lifestyle and preferences. This can significantly narrow down your options.

Condos can be a comfortable and practical starting point. They allow you to own property without having to manage every aspect of the building or grounds, which can make day-to-day life easier, especially if this is your first home.

Apartment Condos

Apartment-style condos can be a practical and comfortable first step into homeownership. They offer predictable monthly costs, shared exterior upkeep, and the freedom to make the interior your own. For many first-time buyers, this creates a manageable, steady start without requiring them to undertake yard work or major repairs immediately.

Williamsville has seen much of Kingston’s recent condo development, with many buildings constructed in the past decade. These buildings are modern, efficient, and conveniently located near transit, groceries, cafés, Queen’s, and both hospitals. Some of them are geared more toward students, so the building’s lifestyle can vary. There are also a few older buildings in the mix, such as the one on Regent St, which tend to have a quieter atmosphere with longer-term residents. The key is to examine the building’s culture closely, not just the unit itself. The nearby waterfront condo buildings are beautiful, but they are generally outside the price range of most first-time buyers.

Moving west, the Queen Mary Road and Greenview pocket offers some of the best value for first-time buyers who want a calm, residential setting. Greenview runs directly off Queen Mary Road, and you can see across Bath Road to the Armstrong Road area from there. These buildings are not flashy, but they are steady, comfortable, nd well-situated near parks, transit, and day-to-day services. Many people who buy here stay for years because the pace of life in this area feels familiar and grounded.

Consider all your options and find the right fit for your first home, whether it be a condo or a detached house.

There are fewer apartment-style condos in the north end, but the ones that do exist offer the advantage of being close to the 401. This is particularly helpful for commuting or when travelling regularly. These buildings tend to be practical, modest, and community-oriented rather than amenity-focused, which keeps ownership costs more approachable.

Your first home journey should feel supportive; choose professionals who understand the unique needs of first-time buyers.

Like all condominiums, each building operates with bylaws that support a respectful living environment. These may include guidelines on flooring, pets, balcony use, and smoking. The purpose is to maintain a quiet, clean, and predictable environment for everyone. We also review the condo corporation’s reserve fund and maintenance history together so you understand how well the building has been cared for and what future expenses may look like. A well-managed building will feel stable, settled, and fair.

Townhome-Style Condos

Townhome condos offer a more traditional neighbourhood living experience, with the added benefit of shared exterior maintenance.

In Bayridge, Twin Oak Meadows (often referred to locally as the Oakview townhouses) sits across from Sexton Place, which is known for its strong management and a stable, well-maintained community feel. Sexton Place is often one of the higher-priced townhome condo developments because of this consistency. Twin Oak Meadows offers a similar lifestyle at pricing often more approachable for first-time buyers.

In the Rosemund area, near Upper Sir John A and Counter Street, the townhome condos offer a familiar, residential feel, where neighbours tend to stay for many years. The appeal is comfort and stability without the upkeep of a detached house. Many young people find this an ideal spot for their first home ownership.

As you enter Amherstview, The Moorings offers the same townhome-style living in a quieter lakeside community, close enough to Kingston if you don’t mind the drive, with the added benefit of the corporation actually owning a piece of waterfront.

Understanding Condo Fees

Condo fees cover shared building insurance, snow removal, exterior maintenance, roofing, and contributions to the long-term reserve fund. A healthy reserve fund helps reduce the likelihood of sudden special assessments. The status certificate, a crucial document, outlines the financial health of the condominium corporation, upcoming work, bylaws, rules, and any planned increases. Your lawyer reviews the status certificate as a condition of the offer, ensuring you understand the corporation’s stability and obligations before moving forward. This review is separate from a home inspection, which assesses the condition of the unit itself; however, many people in apartment-style condos often overlook the inspection. It’s essential to be fully informed about your responsibilities as a condo owner.

Freehold Houses: Privacy, Flexibility, and Responsibility

Keep in mind, your first home is a reflection of your identity. Make choices that resonate with who you are.

Owning a house offers freedom. You choose how your home looks and feels. You have outdoor space. You can renovate and shape your surroundings over time.

Detached homes are often the first image people picture, but they are usually the most expensive option. Many first-time buyers find that semi-detached homes or freehold row houses offer a more comfortable price point while still providing yard space, property control, and the ability to personalize their home. These styles allow you to own the land and the building, just as you would with a detached house, but with a lower entry cost.

The trade-off is responsibility. Roofs, heating systems, driveways, and windows will eventually need attention. The key is choosing a home where the upkeep feels manageable for your lifestyle and budget. A house that needs minor updates can still be an excellent choice if you understand the scope of work involved.

Rural Living: Space, Quiet, and a Different Pace

Rural communities outside Kingston offer more space for the price, along with privacy and natural surroundings. The pace is calmer and quieter. The rhythm is different from city life.

A first home can provide the sanctuary you need. Finding that place is essential for your peace of mind.

You may have:

A well for water that benefits from periodic testing

A septic system that requires pumping every few years

Propane, oil, electric, or wood heating instead of natural gas

Longer travel times for work, groceries, or appointments

Roads that take longer to clear after storms

Some people find rural life grounding and peaceful. Others feel the distance from town does not suit their routines. The right choice is the one that supports your daily life.

Working Together So You Feel Steady and Supported

You should feel empowered throughout this process, especially when purchasing your first home.

I have guided many first-time buyers in Kingston and surrounding communities. The most valuable thing I offer is a calm, experienced eye. When we tour homes, I look for things that are easy to miss if you have never owned before. Signs of moisture. The age and condition of mechanical systems. The care the home has received. Whether repairs are likely soon.

We do not wait for the inspection to start noticing red flags. We begin during the viewing so you can make decisions with clarity, not pressure.

Buying your first home should be a hopeful experience. It should feel like the beginning of something good.

When you are ready to proceed with an offer, your lawyer will review the agreement, handle title searches, coordinate with the lender, and manage the closing process. You may work with any real estate lawyer you choose. The following are examples of well-regarded individuals in the Kingston area;

John Black 613-544-0211 ext. 8070 Jblack@cswan.com

John Wilson (613) 389-4404 jwilson@wgelaw.ca

Carolyn Knight (613) 542-4797 cknight@vinerkennedy.com

Frequently Asked Questions

Ask about potential resale value when considering your first home. It’s a crucial element of your investment.

Do I need a home inspection?

Yes. A thorough inspection provides clarity and protects you from surprises.

How much should I budget for maintenance?

Setting aside a small ongoing amount prepares you for future repairs.

Your first home should be a good fit for your future plans, so think ahead.

How long does it take to find the right home?

There is no set timeline. The right pace is the one that feels clear and steady to you.

Don’t Miss These Guides

Celebrating your first home milestone is a great way to acknowledge your hard work and commitment.

Match the Home You Buy to Your Budget: What Kingston Buyers Need to Know

Choosing the Right Neighbourhood in Kingston and Area

As you settle into your first home, remember to embrace the new experiences and relationships that come with it.