Budgeting for the Hidden Costs of Buying a Home in Ontario

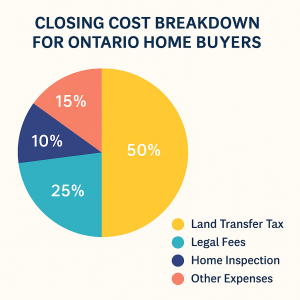

The hidden costs of buying a home in Ontario add up quickly. Beyond the purchase price and mortgage, expenses such as land transfer tax, legal fees, inspections, appraisals, adjustments, moving costs, and utilities can total 3–5% of the price. Buying a home is one of the most significant financial decisions you’ll ever make. While most buyers focus on the purchase price and mortgage payments, several additional costs can easily add up to thousands of dollars. These hidden costs often catch first-time buyers off guard. Here’s what you should know before closing on your home in Kingston or anywhere across Eastern Ontario.

1. Land Transfer Tax – The Largest Single Cost

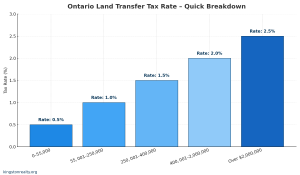

When planning for the hidden costs of buying a home in Ontario, land transfer tax is usually the single largest expense buyers face. When buying property in Ontario, the Land Transfer Tax (LTT) calculation uses the purchase price and the buyer must pay it at closing. Rates range from 0.5% on the first $55,000 to 2.5% on amounts over $2 million.

In Toronto, buyers face an additional municipal LTT, which effectively doubles the tax. In Eastern Ontario communities such as Kingston, Belleville, and Napanee, you’ll avoid this extra fee — but the provincial LTT still applies. On a $500,000 home, expect to pay around $6,475 in provincial LTT (before any rebate).

First-time buyers may qualify for a rebate of up to $4,000, but only if they have never owned property anywhere in the world.

👉 Learn more about Land Transfer Tax rebates for first-time homebuyers on the Ontario government website.

2. Legal Fees and Disbursements

One of the hidden costs of buying a home in Ontario is hiring a real estate lawyer to ensure your purchase is legally sound. Fees generally range from $1,500 to $2,000, including HST. This covers services such as reviewing the Agreement of Purchase and Sale, conducting a title search, registering the property, and handling the transfer of funds.

On top of these fees, you’ll pay for disbursements — expenses your lawyer pays on your behalf. These often include title insurance, courier charges, and government registration fees, which usually add a few hundred dollars to your total bill.

Learn more in our Home Buyer’s Guidebook

3. Home Inspection

A home inspection helps identify potential problems before you complete your purchase. Costs usually range from $400 to $700, depending on the size and age of the property. It’s money well spent to avoid unexpected repair bills down the road. In rural areas, you may need additional inspections such as well water testing, septic system evaluation, or even structural assessments for older homes. These can add $150–$500 each.

👉 Learn more in our guide: Home Inspections — What Buyers Need to Know.

4. Title Insurance

Title insurance protects you and your lender against potential issues with your property title, such as undisclosed liens or boundary disputes. The usual price for these policies is $250 to $400, payable once at closing. Your lawyer will arrange this for you. This coverage remains valid as long as you own the property.

5. Appraisal Fee

Another hidden cost of buying a home in Ontario is appraisal fees. If you’re arranging a mortgage, your lender may require a professional appraisal to confirm the property’s market value. In Kingston and Eastern Ontario, appraisals typically cost $350 to $600, depending on the property’s size, type, and location.

The buyer usually pays this cost directly . While it primarily protects the lender by ensuring they don’t finance more than the home is worth, it also benefits you by providing an independent check that the purchase price is in line with market value.

6. Adjustment costs

Besides standard legal fees and disbursements, you’ll also see adjustments on your closing statement. These are reimbursements to the seller for prepaid expenses, such as property taxes, propane, utility bills, or condo fees.

Your lawyer calculates these adjustments based on your closing date. For example, if the seller has already paid property taxes to the end of the year, you’ll reimburse them for the portion that applies after your possession date.

The amount varies with timing, but most buyers should budget a few hundred dollars to cover these adjustments.

7. Moving Expenses

Professional movers in Kingston and the area typically charge $1,000 to $3,000 for a smaller local move, but the cost can climb much higher depending on your situation. Large homes, specialty items like mirrors, pianos, or electronics, and moves that require careful packing all increase the price.

Distance is another factor: cross-country or out-of-province moves can add thousands more, especially if an overnight crew or storage is required while someone vacates one property and another becomes available.

Even with a DIY move, truck rentals, packing supplies, and fuel can add up quickly, so it’s wise to budget realistically based on the size of your home and the complexity of your move.

💡 Tip from experience:

From a personal standpoint, I’ve found Frank The Mover to be quite reasonable for local moves. That said, I always recommend getting at least three written quotes before choosing a mover. Be sure to check reviews, including the Better Business Bureau (BBB). Unfortunately, there are cases where disreputable movers load your belongings and then demand extra fees before releasing your property. Doing your homework up front helps you avoid stress on moving day.

8. Other Potential Costs

-

Besides the main closing costs, buyers should know several other expenses that can come up; these are often overlooked, but they still form part of the hidden costs of buying a home in Ontario and can affect your budget on closing day.

-

Mortgage Insurance Premium (CMHC): Required if your down payment is less than 20%. This premium is usually added to your mortgage, not paid up front.

👉 Learn more about mortgage insurance from the Financial Consumer Agency of Canada. -

Utility Connection Fees: Charges for setting up or transferring hydro, gas, water, or internet services to your new home. In many of Kingston’s older neighbourhoods, Utilities Kingston provides water, gas, and electricity as a single service. In newer subdivisions and surrounding towns, you may need to deal with different suppliers for each utility. These are often overlooked, but they still form part of the hidden costs of buying a home in Ontario and can affect your budget on closing day..

In rural areas, most homes are not on municipal water or gas. Instead, they rely on wells for water and a variety of heating systems, such as:

-

Propane or oil furnaces

-

Heat pumps (some tied to propane backup, many fully electric)

-

Electric baseboard heating

Each system comes with different operating costs, so it’s important for buyers to understand what’s in place before closing.

-

-

HST on New Home: May apply if you’re buying new construction. It’s often included in the price, but always confirm with the builder.

-

Specialized Reports: In rural areas, additional reports such as a survey, well water test, or zoning compliance letter may be required.

-

Budgeting for the Hidden Costs of Buying a Home in Ontario

Budget 3–5% of your purchase price for closing costs. On a $500,000 home, that’s $15,000–$25,000 besides your down payment.

Understanding the full breakdown of closing costs in Ontario gives you an edge. When you know what to expect — from land transfer tax to legal fees, adjustments, and potential extras — you can move forward with confidence and focus on making your new house a home.

Final Thoughts

The hidden costs of buying a home in Ontario can add thousands of dollars to your budget, but planning makes them manageable. Buying a home isn’t just about the purchase price — it’s about being prepared for everything that comes with it. By understanding land transfer tax, legal fees, inspections, appraisals, adjustments, moving costs, and utilities, you’ll avoid surprises and move into your new home with confidence.

__________________________________________________________________________________________________________________________________________________________________

❓ Frequently Asked Questions About Closing Costs in Eastern Ontario

1. What are the hidden costs of buying a home in Ontario?

Most buyers should set aside 3–4% of the purchase price for closing costs. This covers land transfer tax, legal fees, disbursements, title insurance, and adjustments.

Related reading: Match the Home You Buy to Your Budget: What Kingston Buyers Need To Know

2. What are disbursements, and why do they matter?

Disbursements are out-of-pocket expenses your lawyer pays on your behalf, such as courier fees, title insurance, and government registration charges. They typically add a few hundred dollars to your closing costs.

Related reading: Home Buyer’s Guidebook

3. Do first-time homebuyers pay less in closing costs?

First-time buyers in Ontario may qualify for a land transfer tax rebate, but other costs (legal fees, inspections, title insurance) still apply.

Related reading: Home Inspections: What Buyers Need to Know

4. Can I include closing costs in my mortgage?

Lenders expect you to pay closing costs upfront. Planning for them in advance avoids last-minute financial stress.

Related reading: Kingston Home Maintenance Costs: 21 Ways to Save

📚 Don’t Miss These Guides

Match the Home You Buy to Your Budget: What Kingston Buyers Need to Know 2025-26

Buying confidently starts with understanding what you can comfortably afford. This guide reviews mortgage qualification, debt ratios, budgeting, and practical financial planning tailored to Kingston and area buyers.

House Hunting Online in 2026: Why Working With a REALTOR® Still Matters

Online listings are only part of the story. Learn how local market knowledge, property history insight, negotiation strategy, and professional representation provide advantages that search portals alone cannot offer.

Neighbourhoods in Kingston and Area

Explore established urban communities, west-end family neighbourhoods, rural properties, and waterfront living. Understand how location, amenities, commute patterns, and lifestyle factors influence long-term value and satisfaction.