Buying a home is not for everybody, and if you are someone who is not planning to stay in the area you are currently living for at least 4 more years it does not make a lot of sense; the exception to that here in Kingston may being the student and military residential zones, where rents are high and the selling price for homes has been growing exponentially.

Some people don’t think buying a home makes sense. They feel like renting is a smarter move.On the other hand, some people think renting doesn’t make any sense.

For the most part, arguing it one way or another is about as useful as arguing politics or religion — whatever “side” you’re on, you have your point of view, feelings, and reasons.

But there are also people who are open to debate. If that’s you, read on. This will give you some food for thought and help you make up your own mind about whether it makes more sense to buy a home or rent one.

At least you have the option

Picture living back in Medieval times.

Only a few people are allowed to own land, and you’re not one of them. You are a serf, you can live on a lord’s land, but you’ll have to give him a certain percentage of whatever you grow or raise.

How do you feel about that? Are you OK with that? Is it fair? Probably not…

So, look at it this way: At least now you have the option of buying property. Whether or not you want to exercise that right is your choice.

And it is a choice. You can also decide that you’d rather not own the property you live in. You can certainly still rent from a landlord. (Although they probably won’t accept bushels of wheat, baskets of vegetables, or a goat as payment. You’ll need to somehow convert that to cash money.)

But owning property isn’t for everyone. It comes with responsibilities, risks, and limitations that not everyone is cut out for.

Both come with responsibilities, risks, and limitations

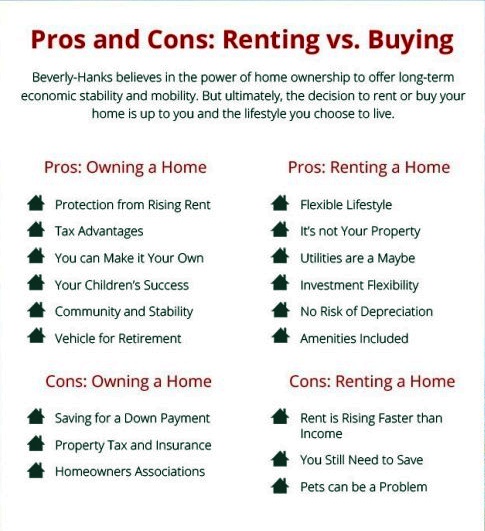

Many people who claim renting makes more sense feel that way because:

- They feel like values are too high. ( Non affordable.)

- They feel like it’s too risky. (The market could crash. Values could go down.)

- They could lose their house (if they lost their job and fell behind on mortgage payments).

- There’s a lot of cost to maintain a house.

- It will “tie them down.” (They won’t be able to move to the coast of Costa Rica and surf for 7 months.)

All of those are valid and possibly true reasons for not buying a home. However, renting also comes with responsibilities, risks, and limitations:

- Rents aren’t necessarily more affordable than buying a house, and they can go up over time (and probably won’t go down).Conversely, the value of a home you own will most likely go up over time, even if it does go down.

- There’s risk that a landlord could not renew a lease and force you to move.

- While you aren’t usually entirely responsible for maintenance, you can be held responsible for things that break or get damaged. You may also be responsible for some upkeep and maintenance costs.

- You don’t have much say in what gets done around the house or apartment. You’re at the mercy of a landlord doing something (or allowing you to do something to it).

- A lease can tie you down as much, if not more, than owning a house that you can choose to sell or rent out if you want to move at some point.

Obviously this isn’t a complete comparison list of risks, responsibilities, and limitations. There are certainly more we could get into. It’s just to make a point, which is…

Whether you buy or rent a home, you will have risks, responsibilities, and limitations placed upon you. The only true solution is to live for free in your childhood home forever and ever — and even that probably isn’t entirely “free” or without responsibilities and limitations.

Here is a handy rent vs own calculator to see if it makes sense for you https://www.nytimes.com/interactive/2014/upshot/buy-rent-calculator.html

Obviously I am in the business to help people buy (and sell) homes, but the choice is yours. If you do decide you wish to buy, I will be happy to chat with you anytime, and also connect you with one of our mines mortgages brokers who can help you start on your way.